Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s edition including a look at how to identify value traps.

Quote of the Day

"In other words, what investors are missing when they compare stock and bond yields is that the former is a real yield while the latter is nominal."

(Lawrence Hamtil)

Chart of the Day

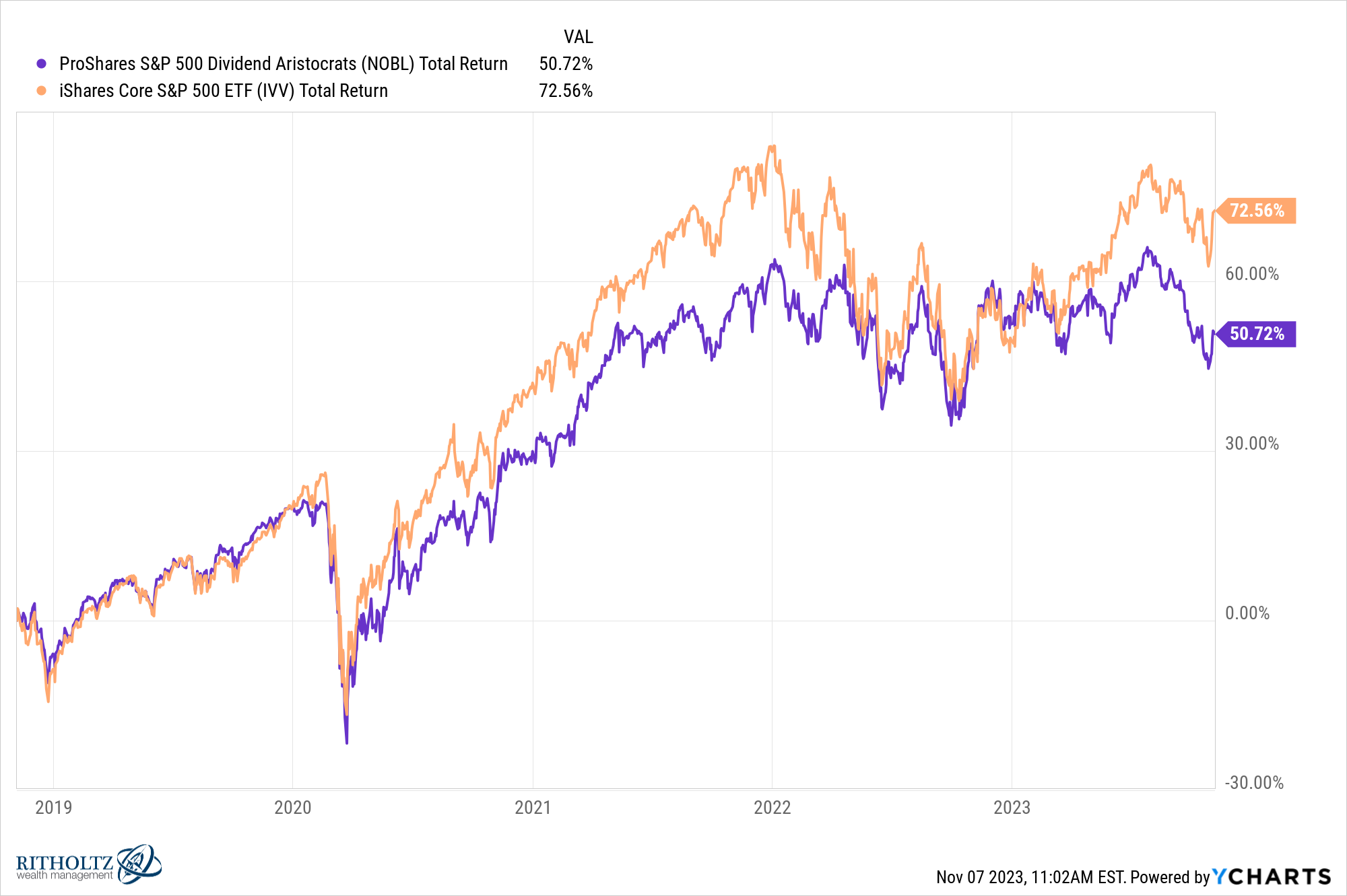

On a risk-adjusted basis the S&P Dividend Aristocrats have performed well over time. (chart via YCharts)

Retail

- Does social media use increase stock market participation? (papers.ssrn.com)

- Why do individual investors converge on the same stocks? (papers.ssrn.com)

Companies

- What is organizational capital and how does it affect returns? (alphaarchitect.com)

- Poor ESG scores don't prevent new share issuance. (papers.ssrn.com)

Quant stuff

- Research shouldn't happen in a vacuum. (mrzepczynski.blogspot.com)

- A round-up of recent white papers including 'Japan: The Land of the Rising Profits.' (bpsandpieces.com)

Research

- Why diversification matters when returns are so skewed. (klementoninvesting.substack.com)

- Good luck trying to time factor premia. (papers.ssrn.com)

- Anomalies don't tell us much about aggregate market returns. (papers.ssrn.com)

- How equity market neutral investing works. (simplify.us)

- How to make risk parity portfolio perform better. (mailchi.mp)

- Why trend followers should want the ability to be short bonds. (caia.org)

- How the number of funds a manger handles affects performance. (papers.ssrn.com)