Quote of the Day

"Diversification is constantly put in jeopardy by our behavioural failings."

(Joe Wiggins)

Chart of the Day

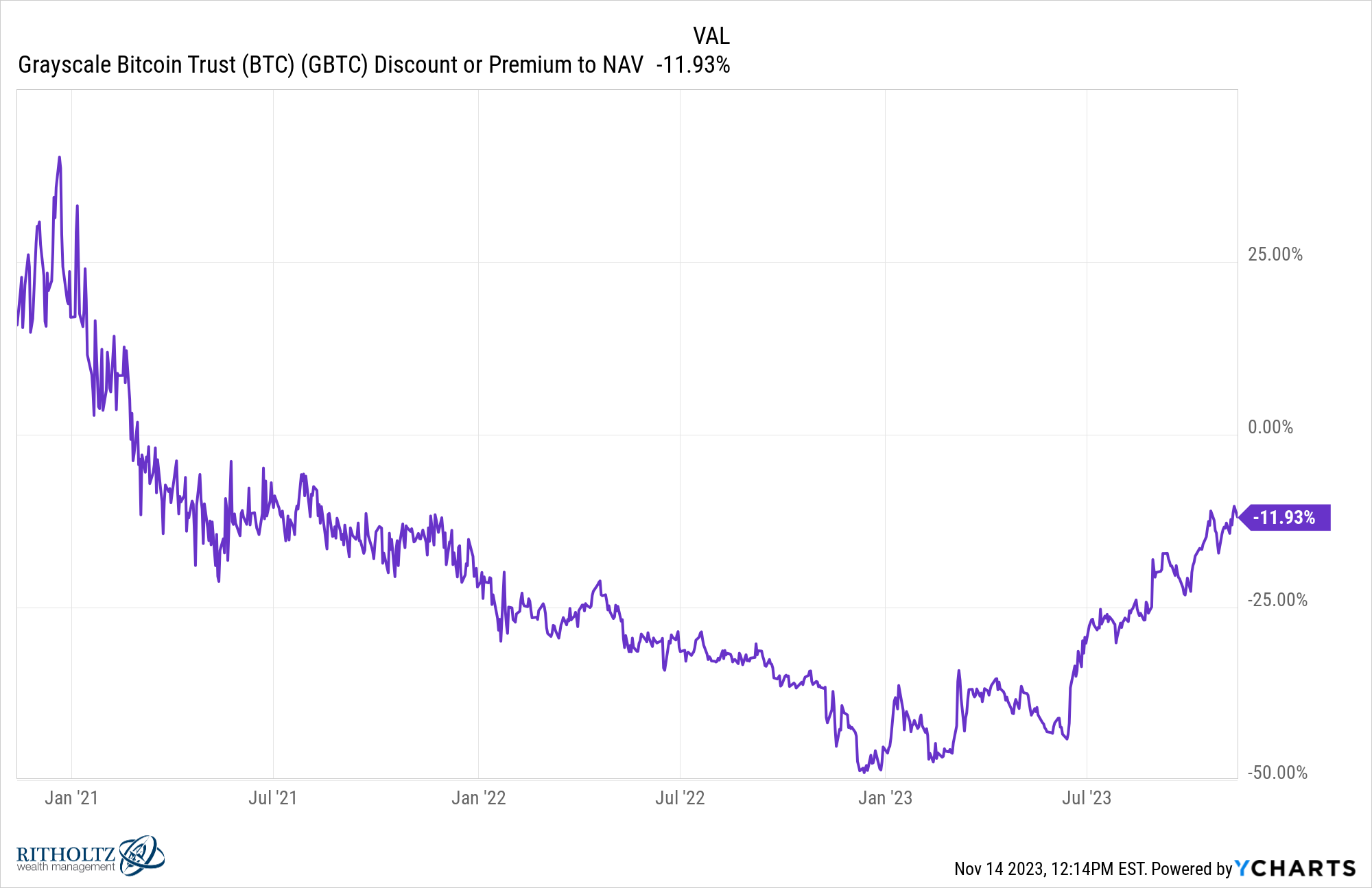

The discount to NAV for the Grayscale Bitcoin Trust ($GBTC) has come down a lot, but is still in the double-digits range. (chart via YCharts)

Markets

- The S&P 500 is set to go from oversold to overbought in a rapid period of time. (twitter.com)

- Why diversification is not a 'free lunch.' (behaviouralinvestment.com)

- The best business books of 2023, including "Number Go Up: Inside Crypto’s Wild Rise and Staggering Fall" by Zeke Faux. (ft.com)

Companies

- Google ($GOOGL) pays Apple ($AAPL) 36% of the revenue it earns from search advertising made through the Safari browser. (arstechnica.com)

- Pfizer ($PFE) wants in on the obesity drug business. (cnbc.com)

- Penn Entertainment ($PENN) has big ambitions for ESPN Bet. (frontofficesports.com)

- Why would a studio, like Warner Bros. Discovery ($WBD), not release any already finished movie? (honest-broker.com)

Fund management

- Smaller multi-manager hedge funds are struggling. (ft.com)

- Where did 777 Partners get capital to buy up professional sports teams? (semafor.com)

Economy

- The October CPI report showed a 3.2% year-over-year increase. (calculatedriskblog.com)

- Shelter costs still have a lot of room to come down. (bonddad.blogspot.com)

- The 'Sahm Rule' is not a law of nature. (ft.com)

Earlier on Abnormal Returns

- Research links: failed signals. (abnormalreturns.com)

- Over a lifetime, you can accumulate a lot of stuff. The chances are nobody wants any of it. (abnormalreturns.com)

- What you missed in our Monday linkfest. (abnormalreturns.com)

- Adviser links: exclusivity and personalization. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)