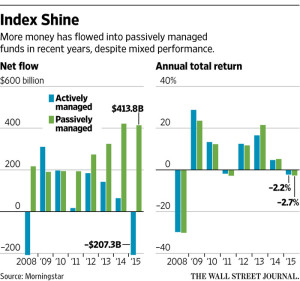

The active-passive debate is at this point a tired one. Since 2012 index funds have convincingly outpaced actively managed mutual funds in terms of asset flows. As Sarah Krouse and Corrie Driebusch at WSJ write:

The shifts are the latest evidence of a sea change in the asset-management business in which investors are increasingly opting for products that track the market rather than relying on managers to pick winners.

The moves have boosted companies such as indexing pioneer Vanguard Group, while hurting firms that have long been synonymous with their star stock pickers.

Source: WSJ

I would argue that the pursuit of lower fees has been a key driver in the push towards passive investments. Every academic study on the performance of mutual funds has shown that lower fees are associated with higher returns. The math is pretty simple.

The rise of ETFs, independent RIAs and robo-advisors has put costs front and center for investors. In addition living in a zero interest rate world has made every cent spent on fees stand out. John Woerth at Vanguard, the biggest beneficiary of this trend, writes:

Obviously, lower costs are good for all investors. But caveat investor. Costs are not universally low. Some firms selectively lower the prices on certain funds (at a loss for the firm) or temporarily lower expense ratios using fee waivers. In the midst of this holiday shopping season, I can’t help but think of doorbuster sales that get shoppers into a store.

Don’t be lured into one low-priced fund only to pay higher fees for other products and services. And check the fine print—fee waivers must be disclosed in prospectuses and websites.

That being said index funds need not been low costs. In addition actively managed funds need not be expensive. The point is that costs matter whether it be at the fund level or at the portfolio management level. One challenge is that some advisors are embracing low, costs index funds while piling on high asset management fees on top. Cullen Roche at Pragmatic Capitalism writes:

We can’t control the returns we’ll earn in the financial markets. But we can control the taxes and fees we pay in those accounts. As the investment landscape shifts and you review your 2016 finances don’t find yourself in a backwards service paying high fees for something that is now being done by a multitude of firms in a truly low fee structure.

In the end real, after-tax returns are what matter for investors. We have no control over what the market(s) do. We have some control over our taxes. The one thing we have complete control over is expenses. There are a plethora of providers who now provide portfolio management services at a reasonable cost, sometimes even free, so don’t be fooled by fund companies and advisors who are still trying to charge high fees in our our free investing future.