Books for the holidays: Creativity, Inc.: Overcoming the Unseen Forces That Stand in the Way of True Inspiration by Ed Catmull.

Quote of the day

Rick Ferri, “Indexes are not asset classes, although many total market indices do represent them fairly well.” (Rick Ferri)

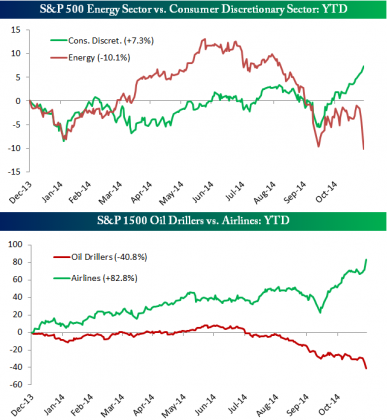

Chart of the day

Falling oil prices have been a lift to consumer stocks. (Bespoke)

Markets

Oil prices are in free fall. (BCA Research, Short Side of Long)

Chinese stocks have underperformed for what seems like forever. (Short Side of Long)

Government bond yields continue to drop across Europe. (FT)

Corporate profit margins continue sit near record highs. (Calafia Beach Pundit)

Strategy

The three P’s of excellent trade execution. (TraderFeed)

Should you take trends into account when rebalancing your portfolio? (Humble Student)

Some evidence that really active funds tend to outperform. (SSRN)

Finance

Hedge fund managers are offering lower fees in return for longer lockups. (WSJ)

The reinsurance industry is undergoing a big transformation. (FT)

How Finance 3.0 is going to change how we invest. (A Wealth of Common Sense)

Funds

A profile of Michael Hasenstab the risk-taking manager of the Templeton Global Bond Fund. (Economist)

A Q&A with Wes Gray of the ValueShares US Quantitative Value ETF ($QVAL). (ETFdb)

Closet indexers are running out of places to hide. (Buttonwood)

Global

OPEC isn’t going to do much to halt the slide in crude oil prices. (Bloomberg, MoneyBeat)

The world is moving at different rates these days. (Market Anthropology)

Earlier on Abnormal Returns

Podcast Friday Wednesday: why podcasting is likely to get more ambitious. (Abnormal Returns)

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Apple ($AAPL) iPhone 6 users are using their iPads less. (GigaOM, Quartz)

Google ($GOOG) aside, smart glasses are not dead. (Technology Review)

Why GoPro ($GPRO) wants to get into the drone business. (The Verge)

You can support Abnormal Returns by visiting Amazon, signing up for our daily newsletter or following us on StockTwits, Yahoo Finance and Twitter.