Quote of the day

Tyler Cowen, “I think of this as a lesson in how bid-ask spreads tend to reemerge, one way or another, no matter how hard we try to abolish them.” (Marginal Revolution)

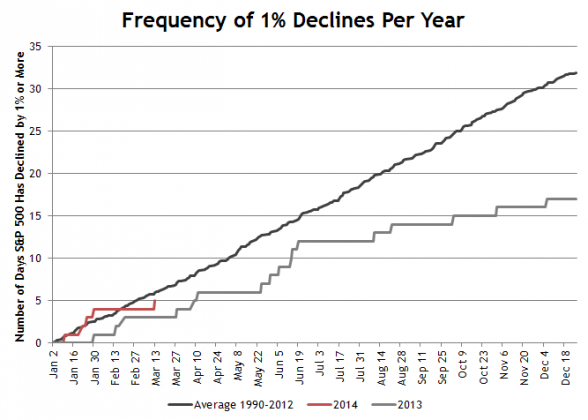

Chart of the day

Setting the baseline: 1% market declines per year. (Avondale Asset)

Markets

Six reasons why the global markets are on edge. (MoneyBeat)

Some questions for China bears. (Humble Student also TRB)

Strategy

Using moving average crossovers as an indicator. (TraderFeed)

Why you should test your market assumptions. (Dynamic Hedge)

More evidence that day trading is a tough business. (SSRN via @cmp_05)

Companies

How Warren Buffett fared in the asset swap with Graham Holdings ($GHC). (FT ALphaville)

What investors should expect from a FTC probe of Herbalife ($HLF). (Herb Greenberg)

Henny Sender, “To invest in new tech requires a totally different mindset than to invest in traditional industrial companies.” (FT)

Finance

Want to improve 401(k) plans? Get rid of “dominated funds.” (Freakonomics)

Despite the headlines 401(k) plans are on average getting better. (NYTimes)

Funds

Four questions to guide your manager search from The Investor’s Paradox: The Power of Simplicity in a World of Overwhelming Choice. (Brian Portnoy)

Checking in on the performance of the ALPS U.S. Equity High Volatility Put Write Index Fund ($HVPW). (ETF)

When are active ETFs really going to take off? (Marketwatch)

ETF statistics for February 2014. (Invest with an Edge)

Bitcoin

Does the world need a ‘Fort Knox‘ for Bitcoin? (WSJ)

Why criminals love Bitcoin. (Reuters)

Warren Buffett has no patience for bitcoin. (Business Insider)

Tracing out the Bitcoin bubble. (InFront Blog)

Global

Japan’s Government Pension Investment Fund may begin ramping up its risk. (Economist)

Economy

Why are small businesses so pessimistic? (Sober Look)

Two more signs the “muddle through” economy is still intact. (Pragmatic Capitalism)

Why has employee turnover dropped? (WashingtonPost)

Why the Fed should explicitly try to overshoot on inflation. (FT Alphaville)

Earlier on Abnormal Returns

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

The average reader only spends 15 second reading a web page. (Time via Daring Fireball)

An interview with Nate Silver on the cusp of the launch of Vox. (NY Magazine)

A quick review of Caffeinated: How Our Daily Habit Helps, Hurts, and Hooks Us by Murray Carpenter. (Scientific American)

You can support Abnormal Returns by visiting Amazon. Don’t forget to follow us on StockTwits and Twitter.