Quote of the day

Charlie O’Donnell, “The next time you don’t like the way you’re being treated, just walk away. Your success is never going to come down to one investor, one employee, one reporter or one job.” (This is going to be BIG…)

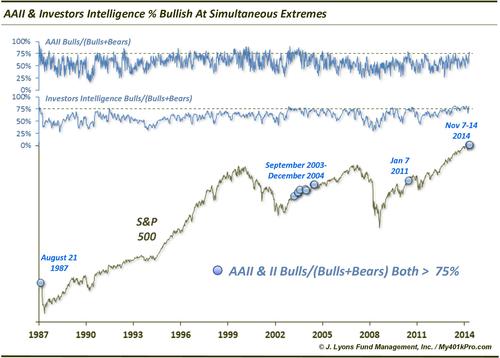

Chart of the day

Individuals and professional sentiment are simultaneously and extremely bullish. (Dana Lyons also Charlie Billello)

Oil

Lower oil prices are going to bite energy-related high yield bonds. (FT)

How correlated are MLPs with oil prices? (Income Investing)

Gold

Gold sentiment is probing all-time lows. (Acting Man via Real Clear Markets)

Gold is only a hedge if you can hold it forever. (Larry Swedroe)

Strategy

Are you a speculator or an investor? (A Wealth of Common Sense)

Does options implied volatility predict the cross-section of returns? (Alpha Architect)

The Fed is not why you are wrong about the market. (Pragmatic Capitalism)

Companies

Warren Buffett’s purchase of Duracell is tax-savvy. (Washington Post, WSJ)

Justin Fox, “Does it really matter if a company has a good mission statement?” (HBR)

Carl Icahn wants a say in who is the CEO is companies he has invested. (MoneyBeat)

Finance

If other industries were like Wall Street. (Morgan Housel)

Wall Street is in a battle for technology and engineering talent. (Dealbook)

Why are pension funds messing about with expensive, complicated alternative assets? (Roger Lowenstein)

Private equity

Rich guys are loading up on private equity. (Private Equity Beat)

Loyalty matters: private equity and venture capital GPs allocate promising funds consistent investors. (SSRN)

Funds

Bill Gross and his Pimco colleagues made A LOT of money last yer. (Barry Ritholtz)

ETMFs are neither open-end mutual fund or ETF. (Total Return, AlphaBaskets)

The ETF Deathwatch for November 2014. (Invest with an Edge)

Global

The European economy is stuck in neutral. (FT)

Economy

October retail sales were “solid.” (Calculated Risk)

Don’t underestimate the strength of the US economy. (Tim Duy)

Earlier on Abnormal Returns

Podcast Friday is up with a look at “textbook arbitrage.” (Abnormal Returns)

What you might have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Paid models for Internet media are few and far between. (A VC)

However Ben Thompson at stratechery is making a go of it. (GigaOM)

A look at the best chromebooks including the Toshiba Chromebook 2. (The Verge)

Support Abnormal Returns by visiting Amazon, signing up for our daily newsletter or following us on StockTwits, Yahoo Finance and Twitter.