Quote of the day

James Surowiecki, “In 1965, C.E.O.s at big companies earned, on average, about twenty times as much as their typical employee. These days, C.E.O.s earn about two hundred and seventy times as much.” (New Yorker)

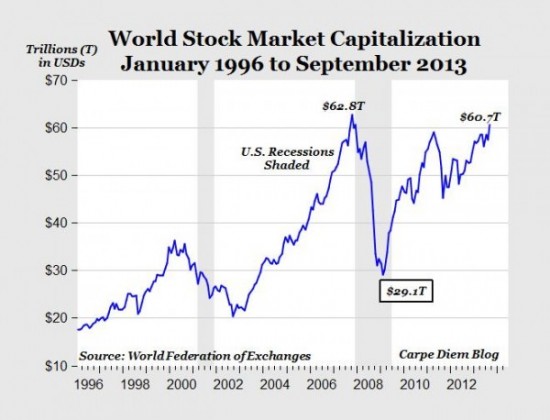

Chart of the day

World stock markets are nearing their pre-crisis highs. (Carpe Diem)

Video of the day

David Rosenberg has shifted his views on bonds. (Wealthtrack)

Markets

We are in a bull market until proven otherwise. (TheArmoTrader also Humble Student)

Hedge funds are as bearish as they have been in a year. (Bloomberg)

Investors focusing too much on Washington and not enough on earnings. (WSJ)

The biggest risk of continued stalemate is to the real economy. (A Dash of Insight)

How analyst estimates typically evolve for companies as the earnings date approaches. (Jason Zweig)

The case for muni bonds. (WSJ via Income Investing)

Strategy

In praise of profitable firms. (Mark Hulbert)

Three thoughts on how to profit from bubbles. (Ivanhoff Capital)

A nice review for John Mihaljevic’s The Manual of Ideas: The Proven Framework for Finding the Best Value Investments. (Reading the Markets)

Financial planning

Financial planning boils down to a few simple things. (Humble Student of the Markets)

The dire outlook for retirees. (Pensions & Investments via @reformedbroker)

Finance

Hedge funds are not rushing to advertise just yet. (FT)

More details on what Josh and Barry are up to these days. (RIABiz)

Is JP Morgan ($JPM) getting unfairly singled-out by regulators? (Felix Salmon)

Twitter is not paying full fees to get its IPO accomplished. (WSJ)

Twiter’s S-1 is filled with drama and a lot of unanswered questions. (Grumpy Old Accountants via @mickwe)

A closer look at Twitter’s revenue recognition policies. (Term Sheet)

How Twitter insiders have saved themselves money through careful tax planning. (WSJ)

Economy

Still no sign of a bubble in real estate agents. (Calculated Risk)

Nobels

Fama, Hansen and Shiller win the Nobel Prize in Economics. (WSJ, Bloomberg, NYTimes)

Why Eugene Fama, and efficient markets, deserved the Nobel. (Tim Harford)

Is there a contradiction in awarding Fama and Shiller the prize? (Marginal Revolution, Long Short, Real Time Economics)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Mixed media

Italians are losing their taste for pasta. (WSJ)

Have a hangover? Drink Sprite. (Huffington Post)

Ten years in Steve Bartman is still keeping a low profile. (NYTimes)

Buzzfeed wants to go global with real-time translations. (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.