Quote of the day

Josh Brown, “If the entities in control of trillions of dollars all want asset prices to be higher at the same time, what the hell else should you be positioning for?” (The Reformed Broker also BI)

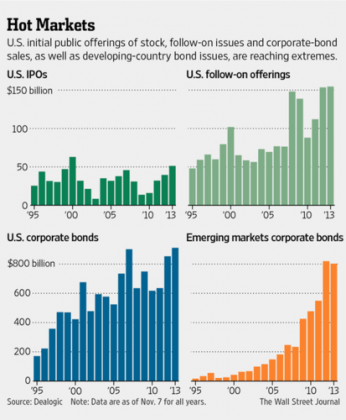

Chart of the day

Forget IPOs. Companies are issuing bonds and secondaries at a record clip. (WSJ)

Markets

Are we in a bubble? (Crossing Wall Street)

The case for muni bonds. (The Guardian)

More signs of investor enthusiasm for equities. (FT Alphaville, WSJ)

The implied volatility on gold miners is coming down. (Focus on Funds)

Apple

Japan has become a growth market for iPhones for Apple ($AAPL). (WSJ)

On the disconnect between Apple the company and its stock. (Kevin Kelleher)

What’s an active user worth? (Asymco)

Retail

Amazon ($AMZN) will soon offer Sunday delivery of packages. (WashingtonPost)

Offline retailers are going to have to push on same-day delivery to keep up. (YCharts Blog)

Lessons learned from the JC Penney ($JCP) fiasco. (Vitaliy Katsenelson)

Some scattered thoughts on Twitter ($TWTR). (Crossing Wall Street)

Firms continue to try and mine Twitter for social signals. (Dealbook)

Twitter is once again looking outside its walls for innovation. (NYTimes)

Finance

Why bother with hedging when investors want long-only hedge funds? (WSJ)

After accounting for risk private equity fund performance is none too hot. (Focus on Funds)

Separating the performance of the publicly traded private equity firms. (Breakingviews)

Banks

Why small bank stocks outperform big bank stocks. (Journal of Finance)

The third wave of online banks are here. (Economist)

Banks are leaving too many opportunities for upstarts. (Dealbook)

Funds

Is equal-weighting an alpha machine? (IndexUniverse)

The flaws of cap weighted indices become magnified in a global setting. (FT)

Are mutual funds disadvantaged by the holdings data they are required to disclose? (Chuck Jaffe)

What you need to know about ETF liquidity. (ETFdb)

Global

Just how cheap are Greek stocks? (IndexUniverse)

Why market cap underweights emerging markets in a portfolio. (Larry Swedroe)

Economy

Austerity at the state and local government level is over for now. (Calculated Risk)

So much for high gasoline prices. (Bonddad Blog)

Earlier on Abnormal Returns

What you may have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

Congratulations to Josh on his fifth blogiversary. (The Reformed Broker)

A look at Laszlo Birinyi’s The Master Trader: Birinyi’s Secrets to Understanding the Market. (Reading the Markets)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.