Quote of the day

Larry Swedroe, “A well-thought-out financial plan is necessary for successful investing, but even the greatest plan won’t bear fruit if an investor doesn’t have the discipline required to stay the course, rebalancing and tax-loss-harvesting as needed.” (ETF)

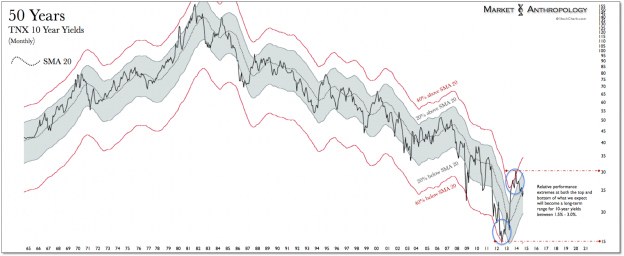

Chart of the day

Just because Treasury yields have stopped going down does not mean they have to go straight up. (Market Anthropology)

Markets

Fed naysayers have missed out on huge profits on Treasury securities. (Bloomberg)

A handful of charts including the big corn bear market. (Short Side of Long)

A long term look at the price of gold adjusted for inflation. (Crossing Wall Street)

Strategy

Using momentum to optimize portfolio rebalancing. (SSRN)

How information leaks affect stock prices. (Adam Grimes)

Size is often the enemy of manager performance. (A Wealth of Common Sense)

Barry Ritholtz talks with economist David Rosenberg. (Big Picture)

Companies

The Alibaba ($BABA) IPO is coming. Should we be worried? (Kid Dynamite also MoneyBeat)

WeChat is a big profit driver for Apple ($AAPL) in China. (Reuters)

Salesforce.com ($CRM) is launching a venture capital arm. (Fortune)

Endowments

There is a disconnect between the time horizon of endowments and their alternative asset managers. (Ashby Monk)

Yale’s endowment fund is becoming climate change-aware. (Dealbook)

Funds

The SEC wants to step up its oversight of mutual funds and their managers. (WSJ)

CTAs are closing up shop in the midst of a long period of underperformance. (FT)

Why five-star funds don’t often stay that way. (WSJ)

Investors really don’t know wheat they are buying in alternative asset mutual funds. (FT)

Global

The global economy (and central bankers) are out of synch. (Business Insider, ibid)

Economy

The case for a more sustainable US economic recovery. (Gavyn Davies)

Earned income continues to grow. (Dr. Ed’s Blog)

Have economists been captured by business interests? (Justin Fox)

Earlier on Abnormal Returns

30 blogs that mutual fund investors should read. (MutualFunds)

What you might have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

You aren’t as busy as you think you are. (Fast Company)

Are autopilots causing pilot skills to atrophy? (New Yorker)

Networking makes us feel physically ill. (Science of Us)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.