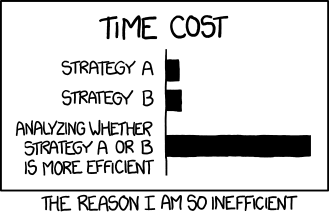

The hardest part about investing isn’t the minutiae of tax-loss harvesting or portfolio rebalancing. For many people simply getting started is the hardest part.* That is why the below comic by Randall Munroe, at xkcd and the author of What If?: Serious Scientific Answers to Absurd Hypothetical Questions, struck me as important.

Source: xkcd.com

The above demonstrates a problem we as consumers (and investors) confront when we are trying to make a decision. We often sweat the details so much so that we lose perspective on what it is we are really trying to accomplish. That is why in many realms, satisificing, or choosing an option that fulfills our needs that may not in fact be optimal can be a great time saver and allows us to move on to other pressing issues. In investing it is oftentimes more important that we stick to a given strategy as opposed to finding the optimal strategy. Ed Batista at HBR quotes Scott McNealy to this effect:

It’s important to make good decisions. But I spend much less time and energy worrying about “making the right decision” and much more time and energy ensuring that any decision I make turns out right.

In the financial blogosphere and financial media we are often confronted with debates about issues that really are important only the margin. Of late discussions about active vs. passive, smart beta vs. dumb beta and alternative assets have been at the front and center. The problem is that issues like these are really peripheral to the big problems facing most average investors.

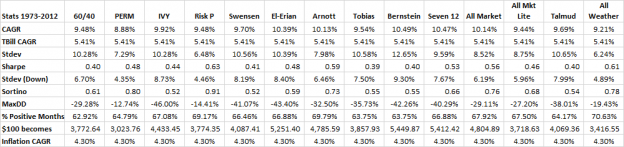

Most investors can safely ignore the debates investment professional have amongst themselves. The chart below from a great Meb Faber post shows that when you compare fourteen popular asset allocation strategies over a long period of time they all pretty much get you to the same place. So despite all the (virtual) ink spilled about the feasability of various strategies they were for all intents and purposes equivalent. In short, if you 50 basis points of annual returns make the different between success or failure you probably haven’t built yourself a “personal margin of safety.”

Source: Meb Faber

So if time spent fussing over optimal portfolio rebalancing frequencies and multi-factor models isn’t time well spent, what is? For most investors simply getting started is key. In my book I use the analogy of trying to get physically fit. The first step is removing yourself from the couch. Cullen Roche at Pragmatic Capitalism makes this very point and just “getting in the game.” He writes:

Most importantly, if you work with a financial expert of any type you’re probably doing more than most other people do in the first place. The vast majority of Americans don’t even own stocks or bonds which is a remarkably silly way to allocate your assets. If you’re even working with a financial expert (even a high fee mutual fund manager who can’t outperform the S&P 500) the odds are that you’re already a step ahead of the average American. And that’s half the battle. While you have to be careful about which “experts” you work with all of these experts are incentivized to get you “in the game” and that’s the part that really matters most.

Luckily for many investors getting started today there many good solutions available to them that weren’t just a couple of years ago. This is in part due to the downward pressure indexed ETFs are having on fees, but something else is going on as well. Matt Hougan at ETF.com in a recent post talks about how the current batch of automated investment advisors, or robo-advisors, provide portfolio solutions that are likely better than what “90% of investors around the world” already have. We can debate the human vs. robo-advisors all day but these services have the potential to provide huge benefits to investors, just starting out, who in some ways most need help investing.

We could spend additional time talking about the nuances of the various strategies followed by robo-advisors. But as we noted before there is not likely to be too much difference between what you get at one service vs. the other. What is important is that all of these services, including a new one by Charles Schwab, are helping to lower costs and transform how individuals get their money managed. Hougan writes:

Will automated investment services replace human advisors? Of course not. There will be, as there always is, a continuum, from do-it-yourselfers to the high-touch ultra-wealthy.

But I do think they’ll be a phase shift downward in what people pay for basic asset allocation advice across this continuum, as new technologies automate and simplify some of the tasks that used to seem so complex to the average investor.

That’s as it should be. And it’s a very good thing.

That is a great thing. Sometimes it is easy to lose perspective on what is important. Debating the nuances of asset class returns is interesting, and on some level, important. But for the vast majority of investors it is neither. Getting started investing and staying in the game trumps trying to eke out an additional few basis points here and there at the expense of simply getting started investing.

*Then again Tom Petty sings “The waiting is the hardest part.” Go figure.

Update: so also Samuel Lee at Morningstar on what robo-advisors really bring to the table.