Quote of the day

Richard Bernstein, “We’re in the middle of one of the greatest bull markets of our careers, and practically no one recognizes it.” (NYTimes)

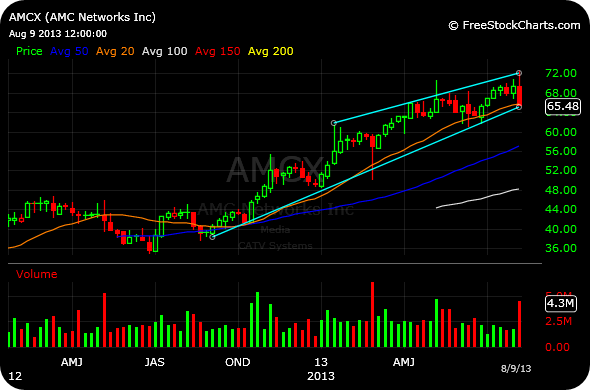

Chart of the day

Can AMC Networks ($AMCX) survive the end of Breaking Bad? (chessNwine)

Markets

By this measure emerging markets are wicked cheap. (Wall Street Rant)

Detroit has put a scare in the muni bond market. (WSJ, ibid)

A look at fair value in the bond market(s). (Institutional Imperative)

Strategy

Why you should look at more than one indicator. (A Dash of Insight)

One big, healthy side effect of high frequency trading. (Noahpinion)

Market timing

Maybe buy-and-hold isn’t right for you. (Alpha Capture)

Mom and Pop are terrible market timers. (Brett Arends)

Finance

Should there be a separate fiduciary standard for IRAs? (Jason Zweig)

How Fannie and Freddie should die. (Econbrowser)

Hedge funds love permanent capital. Thanks JOBS Act. (Dealbreaker)

Why the NYSE ($NYX)-ICE ($ICE) deal makes sense. (MoneyBeat)

ETFs

Are exchanges losing their grip on ETF trading? (IndexUniverse)

A reminder on the effect of volatility on leveraged ETFs. (Dvega/Dtime)

Should investors switch from cap-weighted index funds to alternative weights? (Marketwatch)

Economy

Why are there so few women in central banking? (FT)

In defense of the 30-year fixed rate home mortgage. (Washington Post)

A look back at the economic week that was. (Bonddad Blog)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

We really don’t know what Jeff Bezos will do to transform the news. (Lefsetz Letter)

Should the old guard fear the rise of LinkedIn ($LNKD) as a publisher? (Ad Age via @talkingbiznews)

Why doesn’t Hollywood make more documentaries? (Economix)

A (fictional) history of Apple’s ($AAPL) iWatch. (Anil Dash)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.