Quote of the day

Jason Zweig, “(G)ood advice rarely changes, while markets change constantly. The temptation to pander is almost irresistible. And while people need good advice, what they want is advice that sounds good.” (MoneyBeat)

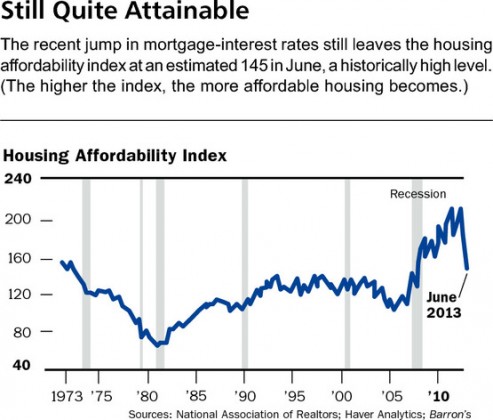

Chart of the day

Housing affordability is off its post-recession highs. (Barron’s)

Markets

Why Summer is no time to press your bets. (Dynamic Hedge)

The markets are still coming to terms with the idea of higher interest rates. (WSJ)

Three notable money managers react to higher interest rates. (A Dash of Insight, ibid)

Strategy

On the dangers of buy-and-hold investing. (Price Action Lab)

Why you shouldn’t gorge on actively managed funds. (Rick Ferri)

Checking on the permanent portfolio performance. (Crawling Road Blog via Monevator)

Companies

Is Google ($GOOG) really worth more than Apple ($AAPL)? (Musings on Markets)

Oracle ($ORCL) seems to be making friends all over the place. (TechCrunch, GigaOM)

Why is Apple still fighting the Feds over e-books? (WSJ)

Finance

Gold miners have a problem: debt. (WSJ)

ETFs

Bonds ETFs: proceed with caution. (Rick Ferri, research puzzle pix)

Some ETF are pulling the old switcheroo. (Invest with an Edge)

Global

The hardest trade on earth right now: emerging market equities. (The Reformed Broker)

The Indian government is trying to tamp down on gold demand. (FT)

Is the ‘Great Recession‘ all that different than past recession? (Big Picture)

Economy

What are markets saying about when the Fed will actually tighten? (Gavyn Davies, Felix Salmon)

How two economists similarly trained can disagree over policy. (NYTimes)

A look back at the economic week that was. (Bonddad Blog)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you may have missed in our Saturday morning linkfest. (Abnormal Returns)

Mixed media

Now that marijuana is legal in many states regulations will soon follow. (Washington Post)

A lot of stuff is going down on July 1st including moving day in Montreal. (Quartz, WSJ)

The ultimate RSS reader cheat sheet. (MarketingLand)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.