Don’t miss out! You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have.

Quote of the day

Robert Shiller, “Speculative bubbles do not end like a short story, novel, or play. There is no final denouement that brings all the strands of a narrative into an impressive final conclusion. In the real world, we never know when the story is over.” (Project Syndicate)

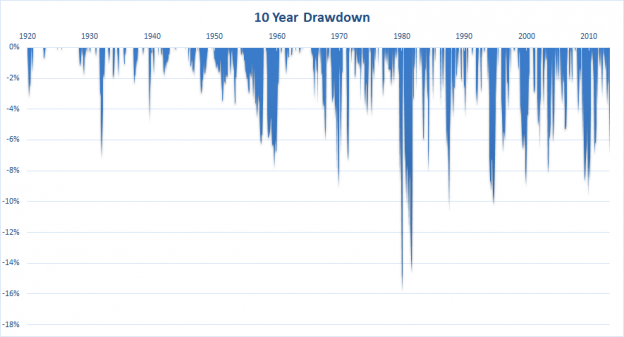

Chart of the day

A look at the bond market’s drawdown. (Mebane Faber Research)

Strategy

On the importance of asking the right questions. (Big Picture)

More notes from the Delivering Alpha 2013 conference. (The Reformed Broker, part 4)

Shareholder Yield: A Better Approach to Dividend Investing by Mebane Faber is free for a limited time. (MFR)

Financial advisers

Financial advisers are retiring at a rapid rate. (Time)

On the challenges of servicing small accounts. (Aleph Blog)

Indexing

Five tips for better index investing. (Rick Ferri)

Index investors are better thought of as low cost investors. (Systematic Relative Strength)

Companies

What next for year 2 of the Marissa Mayer regime at Yahoo! ($YHOO)? (Slate)

Just how quickly is the Microsoft ($MSFT) monopoly getting dismantled? (Business Insider)

Are public companies underinvesting in their businesses? (Morningstar)

Gold mining companies are under serious pressure. (FT)

Media

Apple ($AAPL) is trying to get into television via cooperation not competition. (NYTimes)

Netflix ($NFLX) is now an Emmy contender. (Variety)

ESPN is finally getting some competition via Fox. (Businessweek)

Will sports kill (or save) television? (The Atlantic)

Finance

Some brokers are dipping their toes into social media. (Dealbook)

Why is John Paulson pitching to the CNBC crowd? (Felix Salmon, Market Folly)

On the prospect for some real regulation for the big banks. (Dealbook)

Nelson Peltz wants to get Pepsico ($PEP) and Mondelez ($MDLZ) together. (WSJ, Wonkblog)

Funds

Target date bond ETFs are the “right product at the right time.” (IndexUniverse earlier Abnormal Returns)

On the difference between good leverage and bad leverage. (Morningstar)

Muni investors can hide in VRDOs to avoid higher interest rates. (IndexUniverse)

Economy

Weekly initial unemployment claims again tick lower. (Calculated Risk)

The Philly Fed is pointing higher. (Bespoke)

How far should the Fed go to pop potential bubbles? (Real Time Economics)

Why Miles Kimball of Confessions of a Supply-Side Liberal writes. (Pieria)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Why lemonade tastes so good on a hot day. (Slate)

Why do we think we are all above average? (Priceonomics)

Will this urinal get men to wash their hands more often? (Fast Company)

Some tips on how to sleep better from Dreamland: Adventures in the Strange Science of Sleep by David K. Randall. (Farnam Street)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.