Quote of the day

Morgan Housel, “Work a lot, spend a little, save the difference, invest it wisely, leave it alone. It’s not that hard. We just make it harder than it needs to be. Paying too much attention to the details of markets is a chief culprit.” (Motley Fool)

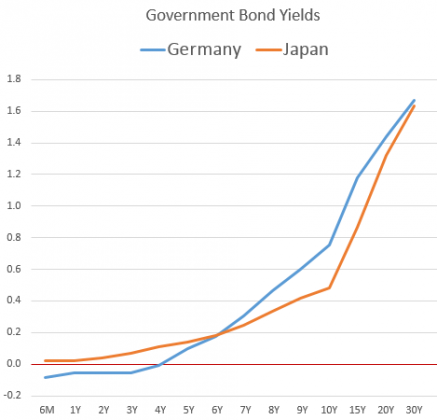

Chart of the day

Yields in Germany and Japan are converging. (Sober Look)

Markets

2014 has been a year of rolling market cracks. (FT Alphaville)

The $VIX has spiked. (Volatility Made Simple, NAS Trading, Short Side of Long)

Why we haven’t seen a bottom yet. (Humble Student)

More signs that energy stocks are oversold. (Bespoke)

How this market differs dramatically than in the past: liquidity. (Cassandra Does Tokyo)

Strategy

Why stock investors get paid. (The Reformed Broker)

Are the wrong types of investors (traders) driving markets these days? (the research puzzle)

There is a “cost to volatility in concentrated funds.” (Aleph Blog)

Meb’s personal portfolio is tilted towards overseas stocks. (Meb Faber)

Lessons learned from Thomas Dorsey. (A Wealth of Common Sense)

Volatility spikes put traders on emotional edge. (TraderFeed)

Companies

Apple ($AAPL) has an iPad problem that today’s announcements are unlikely to fix. (stratechery, NYTimes, Quartz)

CBS ($CBS) is going to start streaming live and on-demand content (for a price). (NYTimes, Fast Company)

Investors really didn’t like Netflix ($NFLX) earnings. (Business Insider)

As HBO and ESPN go, so goes cable. (WSJ)

Finance

Merger deals aren’t done until they are done: they call it “risk arbitrage” for a reason. (WSJ)

Funds

New funds are not all that. (Morningstar)

Low costs matter: active or passive. (Rekenthaler Report)

Investors continue to favor emerging market ETFs that are off the beaten path. (ETF)

The ETF Deathwatch for October 2014. (Invest with an Edge)

Economy

Weekly initial unemployment claims continue to decline. (Calculated Risk)

A look at more indicators pointing toward a strong economy. (ValuePlays)

How will lower oil prices affect the US economy? (Dr. Ed’s Blog, MacroBusiness, Fortune)

Earlier on Abnormal Returns

Why market volatility matters: it makes investors do stupid stuff. (Abnormal Returns)

A great graphic comparing the service the robo-advisors provide. (Abnormal Returns)

A Q&A with Patrick O’Shaughnessy author of Millennial Money: How Young Investors Can Build a Fortune. (Abnormal Returns)

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Daily fantasy sports is a real business. (Recode)

The economics of highbrow, i.e. HBO, content. (The Atlantic)

Admire someone? Send them an e-mail. (Signal vs. Noise)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.