Quote of the day

Suzanne McGee, “Turn off the television. Put down the remote control. Back away from the streaming CNBC content. Turn off the noise.” (The Guardian)

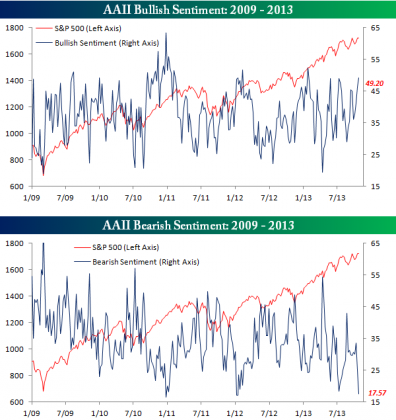

Chart of the day

Where’d all the bears go? (Bespoke)

Markets

It’s taken some effort but retail investors are jumping back in. (The Reformed Broker)

What indices are at new highs? (Big Picture)

What do you really get with an IPO ETF? (IndexUniverse earlier Abnormal Returns)

Strategy

Welcome back to the “age of bullsh*t investments.” (NYMag)

Economic moats are only worthwhile at the right price. (Turnkey Analyst)

The problem with managed futures isn’t what you think it is. (FT Alphaville)

Many investors are still underdiversified. (Capital Spectator)

Finance

The SEC inches toward true crowdfunding rules. (Washington Post, Term Sheet)

Pinterest has raised $563 million in capital. (Pando Daily)

Funds

Sometimes mutual funds are better deals than similar ETFs. (IndexUniverse)

Is Fidelity too late to the ETF game? (InvestmentNews also Focus on Funds, ETF Trends)

Ten ETF launches to look for. (IndexUniverse)

How well do you know ETFs? (Rick Ferri)

Economy

On the part-time employment story. (A Dash of Insight)

Why do some people cling to the idea of economic apocalypse? (FT Alphaville)

Should the government favor index funds? (NetNet)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Don’t let some one else define what success means. (37signals)

Ten things learned from Brad Stone’s The Everything Store: Jeff Bezos and the Age of Amazon. (Farnam Street)

Got three minutes? Don’t check your phone. Do this instead. (Time Back via @allanschoenberg)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.