‘Tis the season. Your smart home needs a “smart hub.” Check out a review of Revolv a smart home automation solution over at TechCrunch.

Quote of the day

Mike Sha, “What people buy and what’s good for them is rarely the same thing…Fees and returns are inversely correlated. Fees are the long term bad egg in every portfolio.” (Pando Daily)

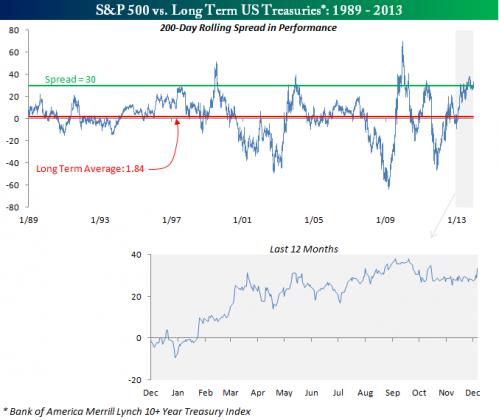

Chart of the day

The S&P 500 has been putting the hurt on the long Treasury. (Bespoke)

Markets

The Value Line Median Appreciation Potential is at historic lows. (Mark Hulbert)

MLPs are underperforming the broader equity market in 2013. (IndexUniverse)

High yield spreads are at six-year lows. (Bespoke)

Negative earnings guidance keeps piling up. (AlphaNow)

Looking for value in the muni bond market in 2014. (Income Investing)

Farmers are stockpiling corn as prices hit multi-year lows. (WSJ)

Strategy

Is it time to take the “Overnight Test” with your portfolio? (Bucks Blog)

Real diversification is tough to find these days. (Marketwatch)

Why do professor pitch buy-and-hold even though valuation measures work? (Morningstar)

There is always cash on the sidelines. (Big Picture, Bloomberg)

Do investors get better with age? (Your Wealth Effect)

Companies

Mary Barra is the new CEO of GM ($GM). (Buzzfeed)

Retail isn’t dead yet. (The Atlantic)

The upside of a new American Airlines. (Time)

Finance

How much in assets does a typical hedge fund need to break even? (WSJ)

The Volcker Rule should be simple. (The Guardian also Daily Ticker)

The forex market is becoming less dealer-centric. (FT Alphaville)

ETFs

How would non-transparent ETFs work in practice? (Focus on Funds)

Don’t buy low volatility ETFs if you fear undeperforming the market. (Focus on Funds)

The most successful new ETFs of 2013. (ETFdb)

Global

Check out the structure behind your Chinese IPO. (Quartz)

Welcome back political instability to the emerging markets. (Fortune)

Economy

The Fed really wants to taper. (Tim Duy)

The balance sheet recession is over. (Pragmatic Capitalism)

Why do measures of inflation disagree? (FRBSF)

Real estate

American consumers are net mortgage borrowing again. (FT)

Americans are staying put more so than ever. (NYTimes)

Suburban office parks are in decline. (Business Insider)

Earlier on Abnormal Returns

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Maybe organic milk really is better for you. (Businessweek, NYTimes)

In praise of garlic powder. (Slate)

Nuts are a super food. (Well)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.