Quote of the day

John Bogle, “Gross return in the stock market, less the cost of playing the game, equals the net return earned by investors as a group. Past. Present. Future.” (Rick Ferri)

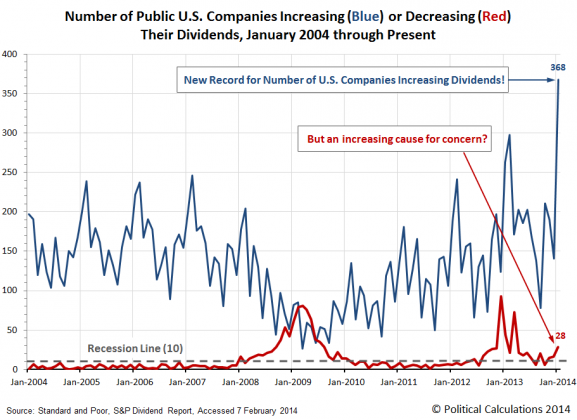

Chart of the day

Check out the big surge in dividend increases. (Political Calculations)

Markets

Oats and coffee are the best performers YTD. (Quartz)

Checking in on the durability of the bull market. (Charts etc.)

Are emerging markets finally oversold? (MoneyBeat)

Biotech bubble: pro and con. (Business Insider)

Strategy

Three types of investors who should sell stocks now. (Carl Richards)

The best single valuation indicator: EV/EBITDA. (Crossing Wall Street)

One huge advantage rich investors have over the rest of us. (Business Insider, Market Folly)

When to ignore investment experts. (Barry Ritholtz)

Strategic Value Investing: Practical Techniques of Leading Value Investors by Stephen M. Horan, Robert R. Johnson, and Thomas R. Robinson is “cogent and comprehensive.” (Reading the Markets)

Companies

What stocks Charlies Munger owns at the Daily Journal Corp. ($DJCO). (Rational Walk)

Horace Deidu, “On a yearly basis iTunes/Software/Services is nearly half of Google’s core business and growing slightly faster.” (Asymco)

What is taking so long? Merge Renault and Nissan already. (FT Alphaville)

A profile of Don Charney and American Apparel. (Buzzfeed Business)

Finance

Can you disrupt banking if you are not actually a bank? (Quartz)

A look the Bitcoin flash crash. (Points and Figures)

Alibaba is getting into financial services. (FT Alphaville also QZ)

Hedge funds

How macroeconomic risk affects hedge fund returns. (SSRN)

Who are the top ten hedge fund managers of all-time? (TRB)

Funds

The three most unloved fund categories of 2013. (Morningstar)

KKR ($KKR) is closing two alternative mutual funds. (Bloomberg, WSJ, )

Economy

Small business optimism ticked up in January. (Calculated Risk)

Debates over the debt ceiling are a wasteful distraction. (FT Alphaville)

Be happy that Stanley Fischer worked at Citibank. (Felix Salmon)

How hard is economics? (Marginal Revolution)

Earlier on Abnormal Returns

What you missed in our Monday linkfest. (Abnormal Returns)

Mixed media

On the benefits of crowdfunding your product. (SSRN)

Is a Harvard degree a liability for entrepreneurs? (Dealbook, Term Sheet)

Why we should teach coding earlier in student’s academic lives. (Pando Daily)

Nanowires could extend the life of Moore’s law. (Quartz)

You can support Abnormal Returns by visiting Amazon. You can also follow us on StockTwits and Twitter.