Quote of the day

Barry Ritholtz, “(I)f your investing process is highly dependent on correctly identifying when a market is about to top and reverse, I expect you will need new investment plan eventually.” (Bloomberg View)

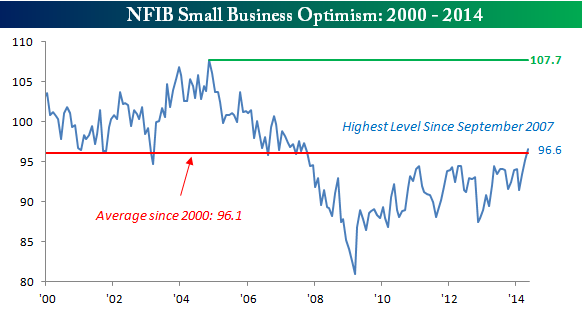

Chart of the day

Small businesses are finally getting optimistic. (Bespoke also Real Time Economics, Calculated Risk)

Volatility

Why the $VIX isn’t a great measure of complacency. (Matt Levine, Buttonwood’s notebook)

How financial conditions help explain low volatility. (Business Insider)

Markets

The math behind protecting your portfolio’s gains. (Alpha Architect)

Valuations matter, but they are not timing tools. (Pragmatic Capitalism)

More signs of an overbought stock market. (Humble Student)

Can we ever really quantify investor sentiment? (Dragonfly Capital)

Metals

Hedge funds are now net short silver. (Short Side of Long)

Are all the moves in gold a function of “market manipulation”? (Kid Dynamite)

Strategy

Does the ‘lottery effect‘ explain the bet against beta factor? (Alpha Architect)

A look at implied equilibrium risk premia forecasts. (Capital Spectator)

Resources

Five favorite investment books including Inside the Investor’s Brain: The Power of Mind Over Money by Richard L. Peterson. (Millenial Invest)

Jerry Parker talks with Michael Covel about the difference between trend following and managed futures. (Trendfollowing Podcast)

Introducing the top ten advisor blogs. (Nerd’s Eye View)

Companies

Warren Buffett is planning to bet big on renewable energy. (Blooomberg)

Why GE ($GE) continues to invest in management education. (Slate)

How did Valeant Pharma ($VRX) get so big, so fast? (Bronte Capital)

A great example of the winner’s curse. (WSJ)

Why Uber’s valuation makes sense. (stratechery also Dealbook, Haywire, FT Alphaville)

Finance

Why bank traders have a hard time running hedge funds. (Points and Figures)

The SEC is now looking at bank-run dark pools. (WSJ)

Life insurance sales are in an epic slump thanks in part to Millenials. (Bloomberg)

ETFs

iShares is doubling the number of low cost, ‘core’ ETFs. (ETF)

Why Alpha Architect think there is room for quant-run ETFs. (Morningstar)

Global

Why Europe should want to see a rise in bond yields. (MoneyBeat)

How can Spanish debt be a deal at these levels? (MoneyBeat also Bespoke)

Is India’s stock market now expensive? (FT)

Economy

A prominent economist thinks the US economy is now growing at an above trend pace. (Business Insider)

Americans are not all that optimistic about house prices. (Real Time Economics)

The student loan problem is multi-dimensional. (FT Alphaville)

Earlier on Abnormal Returns

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Is Tai Chi the new yoga? (Slate)

What type of sunscreen is best? One that you will use. (WSJ)

Seth Godin, “If you try to delight the undelightable, you’ve made yourself miserable for no reason.” (Seth Godin)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.