Quote of the day

Mark Hulbert, “Humility throughout life is a virtue, but especially in the investment arena. And yet success leads to just the opposite: overconfidence.” (Marketwatch)

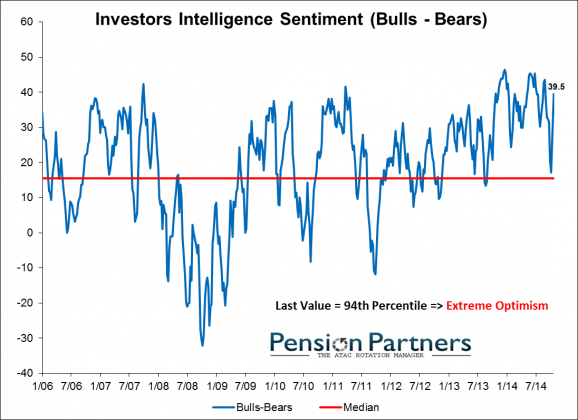

Chart of the day

The market battle today is between momentum and elevated sentiment. (Charlie Bilello)

Commodities

The decline in the oil majors has been quite epic. (Josh Brown)

Why gold has lost its luster. (Dr. Ed’s Blog)

The case for corn. (Almanac Trader)

Strategy

The myth of passive investing is under attack. (Pragmatic Capitalism)

Don’t bother with individual stock momentum. (Dual Momentum, the book)

A hearty recommendation for Andrew Ang’s Asset Management: A Systematic Approach to Factor Investing. (GestaltU)

Companies

Apple ($AAPL) should buy Tesla ($TSLA). (Business Insider)

How Pandora ($P) plans to grow. (Fortune)

Why Costco ($COST) is crushing the competition. (First Adopter)

Warren Buffett “stole” BNSF. (Bloomberg)

Finance

Secondaries are surging including those from GoPro ($GRPO). (Dealbook)

Actionable evidence on security breaches at banks is rare and difficult to acquire. (Dealbook)

IEX Group has captured 1% of trading volume. (Bloomberg)

Goldman Sachs ($GS) partners still get some interesting perks. (Bloomberg)

ETFs

Charles Schwab ($SCHW) is not kidding around about its robo-advisor product. (RIABiz)

Global

Global economic news flow turned gloomy in October. (Real Time Economics)

Israel’s start-up scene is booming (and running out of workers). (FT)

Economy

Why a 2015 recession is unlikely. (Calculated Risk)

Earlier on Abnormal Returns

What you might have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

What is net neutrality? (The Upshot)

Why are US internet speeds so slow? (Science Friday)

What are the chances that net neutrality succeeds? (kottke, A VC)

Support Abnormal Returns by visiting Amazon, signing up for our daily newsletter or following us on StockTwits, Yahoo Finance and Twitter.