Quote of the day

Stephen Gandel, “Saying leveraging up your portfolio is safe as long as you buy bonds, is just the type of talk you would expect at the end of a bond bubble.” (@stephengandel)

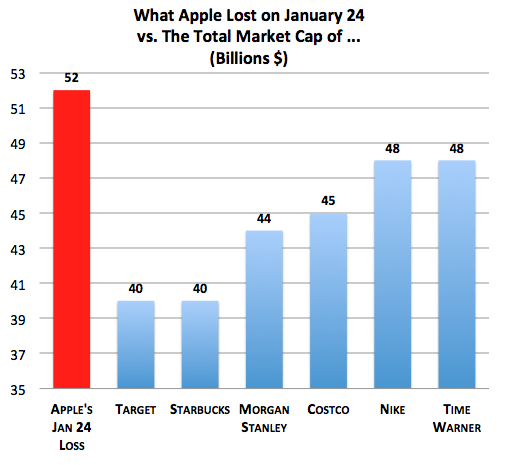

Chart of the day

Putting Apple’s loss in market cap into perspective. (The Atlantic)

Markets

More signs that risk aversion is on the wane. (Sober Look)

How to measure market health. (Ivanhoff Capital)

Junk bonds don’t have to tank in 2013. (LearnBonds)

Strategy

There’s no such thing as “house money.” (Howard Lindzon)

Penny stock performance: bad, really bad. (Aleph Blog)

How to sort strategies. (Cassandra Does Tokyo)

Companies

There’s nothing wrong with Apple ($AAPL) besides its stock price. (Slate also SAI)

Is the luxury goods boom finally over? (Fortune)

2013 is the year of web video, seriously. (Howard Lindzon)

Finance

Why Bank of America ($BAC) should spin-off Merrill Lynch. (The Brooklyn Investor)

Can the SEC go from reactive to proactive with a new head? (New Yorker)

The pivot from finance to startups is trickier than it looks. (Dealbook)

Charlotte is competing as a finance hub on its lower cost of living. (Businessweek)

ETFs

How the ETF price war is helping…advisers. (The Reformed Broker)

Twenty years in the ETF has been a resounding success. (Economist)

Has the rise of indexed ETFs changed market structures? (FT)

Global

A study in economic contrast: Germany and the UK. (The Source also Quartz)

Cyprus is almost surely going to default. (Felix Salmon)

China’s college graduates are getting pretty picky about jobs. (NYTimes)

Can Canada manage itself out a housing bubble without much damage? (The Atlantic)

Economy

Conflicting signals on the health of the US manufacturing sector. (Real Time Economics)

All signs point to a rosier housing economy. (NYTimes also Money Game)

How self-driving cars change everything, including infrastructure spending. (Felix Salmon)

Mixed media

We don’t know if half of our medical treatments work. (Wonkblog)

Your home’s next thermostat will be “connected.” (GigaOM)

McDonald’s ($MCD) Filet-o-Fish is going sustainable. (Money & Co.)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.