Quote of the day

Howard Marks, “I keep going back to what Charlie Munger said to me, which is none of this is easy, and anybody who thinks it is easy is stupid. It is just not easy.” (BeyondProxy)

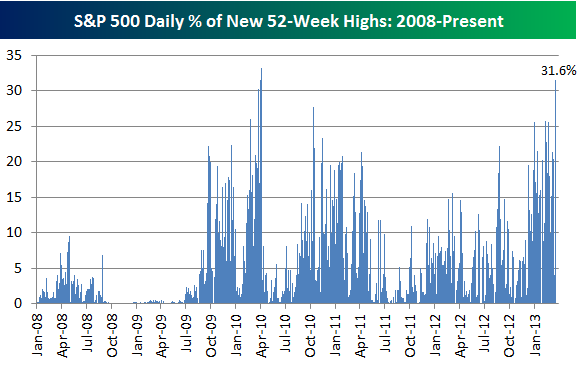

Chart of the day

Check out the breakout in new highs. (Bespoke)

Markets

Health care stocks are on a tear. (Charts etc.)

Individual investors are not buying into the rally. (Big Picture)

Stocks only look cheap relative to bonds. (Turnkey Analyst)

The Brent-WTI spread is at a 52-week low. (Bespoke)

Strategy

On the dangers of adjusting historical data. (Mebane Faber Research)

Even hedge funds need to be tax-aware. (Deal Journal)

Investors need to invert how they spend their time. (StockCharts Blog)

Companies

Microsoft ($MSFT) is running out of strategic options. (Pando Daily)

What Ron Johnson got right. (HBR)

Why did Buffett change his playbook with Heinz ($HNZ)? (Term Sheet)

Bitcoin

What a crash looks like. (Money Game)

The Winkelvii are big Bitcoin fans. (Dealbook)

No one knows what a Bitcoin is worth. (ArsTechnica)

What’s the future of ‘Bitconia‘? (Free exchange)

Finance

On the upside of market halts. (Kid Dynamite)

Where did all the trading volume go? (WSJ)

A look at JP Morgan’s ($JPM) 2012 annual report. (The Brooklyn Investor)

The biggest trade of 2012. (WSJ)

“Tier I investment banks are un-investable…” (Dealbook)

Motif Investing raises a big round including from Goldman Sachs ($GS). (Pando Daily, Dealbook)

ETFs

The ETF Deathwatch for April 2013 shrunk. (Invest With an Edge)

The barriers to entry for upstart ETF providers are falling. (FT)

Another take on the permanent portfolio. (Morningstar)

Economy

Is retail running out of steam? (Sober Look, Pragmatic Capitalism)

State government tax revenue just hit an all-time high. (Real Time Economics)

Success breeds success for John Bates Clark medal winners. (Real Time Economics)

Which makes us feel worse: inflation or unemployment? (Wonkblog)

Mixed media

Sports radio is killing it. (THR)

What it takes to be a data scientist these days. (Wired)

Twitter data shows people are happier the farther away from home they are. (Phys.org)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.