Quote of the day

Charles Kirk, “Making mistakes is part of the game and we all make our fair share. If you can honestly forgive yourself right now, you will take the first step toward having your best year ever.” (Kirk Report)

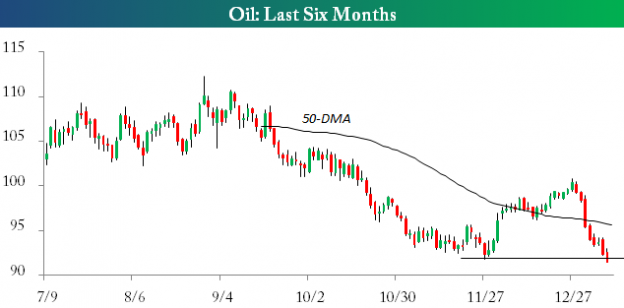

Chart of the day

Crude oil has given up is December gains. (Bespoke)

Markets

Warren Buffett’s favorite valuation indicator shows the stock market to be overvalued. (Business Insider)

Momentum works at the asset class level. (Systematic Relative Strength)

Why aren’t there chicken futures? (Wonkblog)

Strategy

Four reasons to use investment checklists. (Institutional Investor)

Evidence that investors confuse brains with luck. (SSRN via @jasonzweigwsj)

Is sell-side research more valuable in bad times? (NBER via Bloomberg)

Companies

Apple ($AAPL) continues to make inroads into Corporate America. (WSJ)

Why is FedEx ($FDX) stock continuing to go higher? (research puzzle pix)

Finance

The hedge fund industry defends itself. (FT Alphaville)

Apollo Global Management ($APO) just raised a huge buyout fund. (FT)

Blackrock ($BLK) got slapped down by the New York AG despite doing nothing wrong. (Felix Salmon)

ETFs

MFS is getting into the actively managed ETF game. (Focus on Funds, InvestmentNews)

Mutual funds once again have a tax problem. (Turnkey Analyst)

Economy

The December jobs report was a big disappointment. (Calculated Risk, Quartz, Felix Salmon, Bonddad Blog, )

The pre-NFP case for an accelerating economy. (FT Alphaville)

Market-derived inflation expectations are on the rise. (Capital Spectator)

Who does the Fed serve? (Pragmatic Capitalism)

Earlier on Abnormal Returns

What you missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Why self-sustaining mobile apps like SnapChat are so rare. (Haywire)

John Rekenthaler test drives Betterment. (Morningstar)

The ways in which aerial drones could be used in the real world. (Daniel Nadler)

You can support Abnormal Returns by shopping at Amazon. You can also follow us on StockTwits and Twitter.