Quote of the day

Justin Fox, “Bubbles arise if the price far exceeds the asset’s fundamental value, to the point that no plausible future income scenario can justify the price.” (HBR)

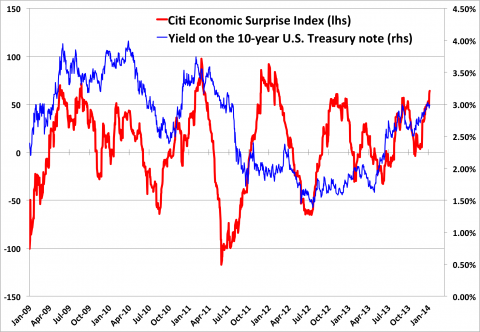

Chart of the day

The Citigroup Economic Surprise Index is looking a bit toppy. (Business Insider)

Markets

Is the staples sector ready to outperform? (Andrew Thrasher)

Do rising interest rates automatically crush stock prices? (A Dash of Insight)

Where bond valuations are stretched. (BCA Research)

Why the Great Rotation is overrated. (Michael Santoli)

Jesse Eisinger, “Bubble-consciousness means that investors, the media and the public may finally be mistrustful. Considering how treacherous the markets are, that mistrust is warranted.” (ProPublica)

Commodities

How the Aussie dollar and gold trade together. (Market Anthropology)

Wheat continues its path lower. (Sober Look)

Natural gas drilling patterns are shifting. (MarketBeat)

Companies

Is T-Mobile ($TMUS) going to end the cellphone contract cartel? (Slate, Credit Writedowns, WSJ, NYTimes)

How often should CEOs check their stock prices? (Aleph Blog)

Finance

JP Morgan ($JPM) is now untouchable by the government. (Felix Salmon)

2013 was a big year for boutique investment banks. (Dealbook)

Angel investors were busy in 2013. (TechCrunch)

Hedge funds

Bridgewater Associates had a rough 2013. (Dealbook)

Hedge funds are a “gigantic hidden tax on the wealthy.” (Brett Arends)

SAC alums are having no problem raising money for new funds. (NetNet)

ETFs

New flavors of emerging market bond ETFs are coming. (IndexUniverse)

Three lessons from ETF flows in 2013. (Morningstar)

Investors who rebalance are doing themselves a favor. (IndexUniverse)

Global

The fiscal drag will lessen in 2014. (Pragmatic Capitalism)

The case for emerging market equities: valuation. (MoneyBeat)

European index charts look pretty bullish. (Charts etc., The Reformed Broker)

Economy

Weekly initial unemployment claims continue to trend lower. (Calculated Risk, Capital Spectator)

What a divided Fed means for policy. (Tim Duy, WSJ)

Five risks to the economy. (Pragmatic Capitalism)

Tim Harford, “Commitment strategies are now cool in macroeconomic policy.” (Tim Harford)

Earlier on Abnormal Returns

What you missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Managing Twitter streams is becoming too difficult. (Mathew Ingram)

Curved TV screens don’t count as innovation. (Farhad Manjoo)

Is wearable tech a fad or the future? (Daniel Gross, Minyanville)

You can support Abnormal Returns by shopping at Amazon. You can also follow us on StockTwits and Twitter.