You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Barry Ritholtz, “The problem with storytelling is that it makes an investor feel good, even as the data show the opposite and the position goes against him.” (Bloomberg)

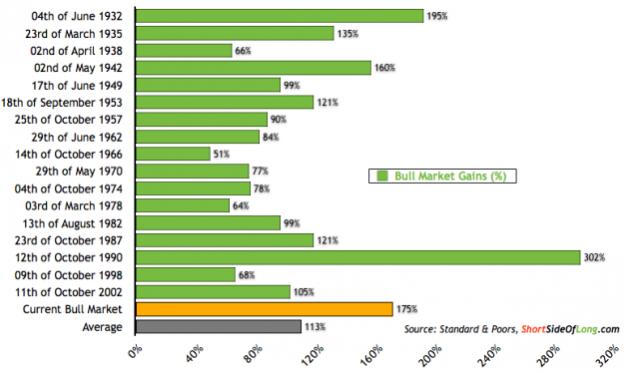

Chart of the day

Comparing bull market gains. (The Short Side of Long)

Strategy

Why rebalancing has become more important to investors. (Capital Spectator)

Just another sign that shorting is a tough game. (research puzzle pix)

Companies

When will Watson become a big business for IBM ($IBM)? (WSJ)

Finance

The stories behind the top-performing 100 biggest hedge funds. (Bloomberg)

JP Morgan ($JPM) has paid $20 billion in fines in the past year. (Dealbook)

Foreign exchange volume dropped dramatically in 2013. (FT)

Commercial paper issuance is making a comeback. (FT)

ETFs

ETFs are not all low-cost, index trackers. (Indexology)

There is only so much room in the ETF game for the big players. (FT)

ETF statistics for December 2013. (Invest with an Edge)

Global

Emerging market P/Es are 1/3 lower than in the S&P 500. (WSJ)

Japan’s new tax-free investment accounts should spur investing. (MoneyBeat)

Demand for peripheral European bonds is strong. (FT, MoneyBeat)

Economy

The December ADP report points towards jobs gains. (Calculated Risk)

Will the Fed ditch the Evans Rule? (Crossing Wall Street)

The manufacturing economy is leading the way. (Econbrowser, MoneyBeat)

The ten biggest myths of economics. (Pragmatic Capitalism)

Earlier on Abnormal Returns

What you missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Tyler Cowen is very high on the forthcoming book from Megan McArdle The Up Side of Down: Why Failing Well Is the Key to Success. (Marginal Revolution)

Confide is the SnapChat for text. (Businessweek, Business Insider, Term Sheet)

What happens when you “nuke” your Twitter feed. (Buzzfeed)

You can support Abnormal Returns by shopping at Amazon. You can also follow us on StockTwits and Twitter.