Quote of the day

Floyd Norris, “It [Dell] has spent more money on share repurchases than it earned throughout its life as a public company. Most of those repurchases were at prices well above current levels.” (NYTimes also Dealbook)

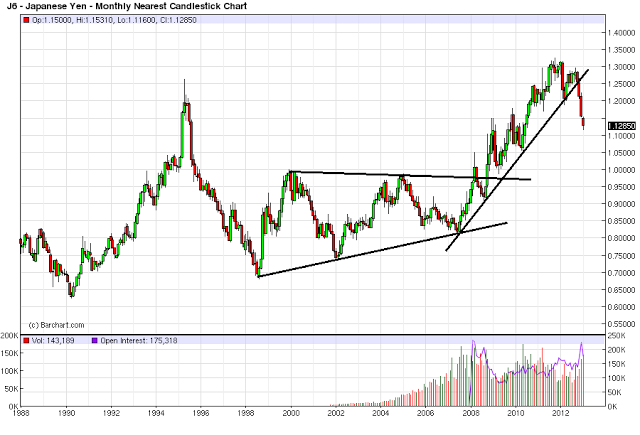

Chart of the day

Putting the move in the Japanese Yen into long term perspective. (Bonddad Blog also Global Macro Monitor)

Markets

Why aren’t traders buying more call options? (Barron’s)

Bad things happen in markets, just not the way everyone thinks they do. (The Reformed Broker)

A below-average four year return forecast for stocks. (Mark Hulbert)

Muni bonds

Investors are flocking to muni bond funds. (Bond Buyer)

How might the muni bond market react to various tax rule changes. (Learn Bonds a

Muni bond buyers beware. (Reuters)

Strategy

On the attraction of “boring stocks.” (FT via In Pursuit of Value)

Fun with relative price charts. (Dynamic Hedge)

Mea culpas for 2012. (Big Picture)

5 steps to becoming a trader. (Kirk Report)

Companies

Text messaging is beginning to wane globally. (Asymco)

Is Avis ($CAR) going to screw up ZipCar ($ZIP)? (Fortune)

Google ($GOOG) declares war on passwords. (Wired)

Finance

Does Dell ($DELL) presage a return to big buyouts? (WSJ, Buttonwood’s notebook)

What is Goldman Sachs ($GS) and Morgan Stanley ($MS)? (NetNet, Quartz)

GE ($GE) is still heavily dependent on GE Capital. (Quartz)

Now political intelligence firms are in the insider spotlight. (WSJ)

Startups

What does it mean for the IPO market when companies can raise (nearly) unlimited private capital? (Continuations)

Startups are the new MBA. (Huffington Post)

Venture capital funding was down in 2012. (AllThingsD, GigaOM)

Hedge funds

Hedge funds disappoint again. (CBS News)

Small hedge funds top large ones again. (Reuters)

Hedge fund activists are once again on top. (Businessweek)

Funds

A real-world benchmark for asset allocation. (Capital Spectator)

A closer look at Doubleline and TCW bond performance. (MPI Research)

Global

China’s growth has downshifted. (FT Alphaville, Quartz, beyondbrics, NYTimes, RTE, Money Game)

Jobs are coming home to the developed markets. (Economist)

Euro high yield debt (and CEE debt) is getting frothy. (WSJ, Institutional Investor, FT, The Source)

Emerging market firms are quickly becoming multinationals. (Economist)

Economy

The US drought is not over. (FT)

The mortgage refinancing boom is over. (Fortune)

What LA port traffic tells us about changing global trade flows. (Economist)

Mixed media

How online courses affect the four objectives of the US college system. (Rick Bookstaber)

Why are we spending so much more on college sports? (The Atlantic)

Why is young adulthood so memorable? (Slate)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.