Since today is a market holiday we are producing just one linkfest today. We hope you enjoy the time off.

Quote of the day

Wade W. Slome, “The equity investing game may be more difficult today, but investing for retirement has never been more important.” (Investing Caffeine)

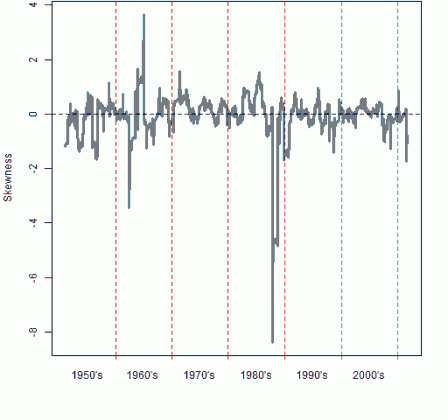

Chart of the day

Does the skewness of the S&P 500 change over time. (Portfolio Probe)

Video of the day

Peter Fisher and Dan Fuss talk bonds with Consuelo Mack. (Wealthtrack)

Markets

Are low Treasury yields all that out of whack? (EconomPic Data)

Should we care about a collapse in the Baltic Dry Index? (Bespoke)

The dumb money is getting bullish. (The Technical Take)

Traders are using currencies as proxies for other risk assets. What could possibly go wrong? (WSJ)

Companies

The casual dining sector is perking up. (chessNwine)

Lululemon ($LULU) great company at a full price. (YCharts Blog)

Groupon ($GRPN) CEO Andrew Mason interviewed on 60 Minutes. (AllThingsD)

Apple

Apple ($AAPL) is the world’s largest PC maker. (Asymco)

A look at Apple Q4 estimates. (Leigh Drogen)

A nice review of Adam Lashinsky’s Inside Apple: How America’s Most Admired–and Secretive–Company Really Works![]() . (Bob Sutton)

. (Bob Sutton)

Finance

In defense of Bain Capital. (The Epicurean Dealmaker, The Reformed Broker)

Clearing houses should be wary of their success. (Reuters)

Personal finance

Wall Street is lining up to manage all the newfound wealth in Silicon Valley. (Dealbook)

Is there a better way to analyze investor risk tolerances? (Tradestreaming)

Hedge funds

Hedge funds want to be able to do general solicitations. (FT)

Hedge funds seem to be disproportionately good at owning M&A targets. (SSRN via @jasonzweigwsj)

ETFs

The mutual fund industry is losing share to ETFs. (Sober Look)

Ten ETFs worth a second look. (Financial Advisor)

The dangers of leveraged ETFs. (Horan Capital)

Global

Is the ECB on the verge of a “buyer’s strike”? (Finance Addict)

A Greek default is on the clock. (Real Time Brussels, Bloomberg, Buttonwood)

Europe has few ideas other than austerity. (Economist’s View)

What are the real inflation risks of current central bank policies? (Gavyn Davies)

How big a deal is the France downgrade? (FT Alphaville)

The price of natural gas on both sides of the Atlantic is diverging. (The Source)

A rare sign of good economic news in Japan. (FT Alphaville)

Economy

Unmasking the ECRI WLI. (Bonddad Blog)

Does the slope of the yield curve still work as an economic indicator? (Capital Spectator)

What effect might an Iranian oil embargo have on oil prices. (Econbrowser)

Week in review/preview

Where markets stand coming into the week. (Global Macro Monitor)

The economic schedule for the coming week. (Calculated Risk)

Don’t expect great things from earnings this week. (A Dash of Insight)

Mixed media

Scarcity is a bad business model. (A VC)

How to lie with graphs. (FT Alphaville)

Robert Harris’ The Fear Index![]() gets finance right. (Felix Salmon)

gets finance right. (Felix Salmon)

Today, “Blue Monday,” is the most depressing day of the year. (The Source)

Abnormal Returns is a founding member of the StockTwits Blog Network.