Quote of the day

Michael Santoli, “Over a longer span, the relaxation of market fears such as just unfolded has tended to be more positive than not for the market over a multi-month horizon.” (Yahoo! Finance)

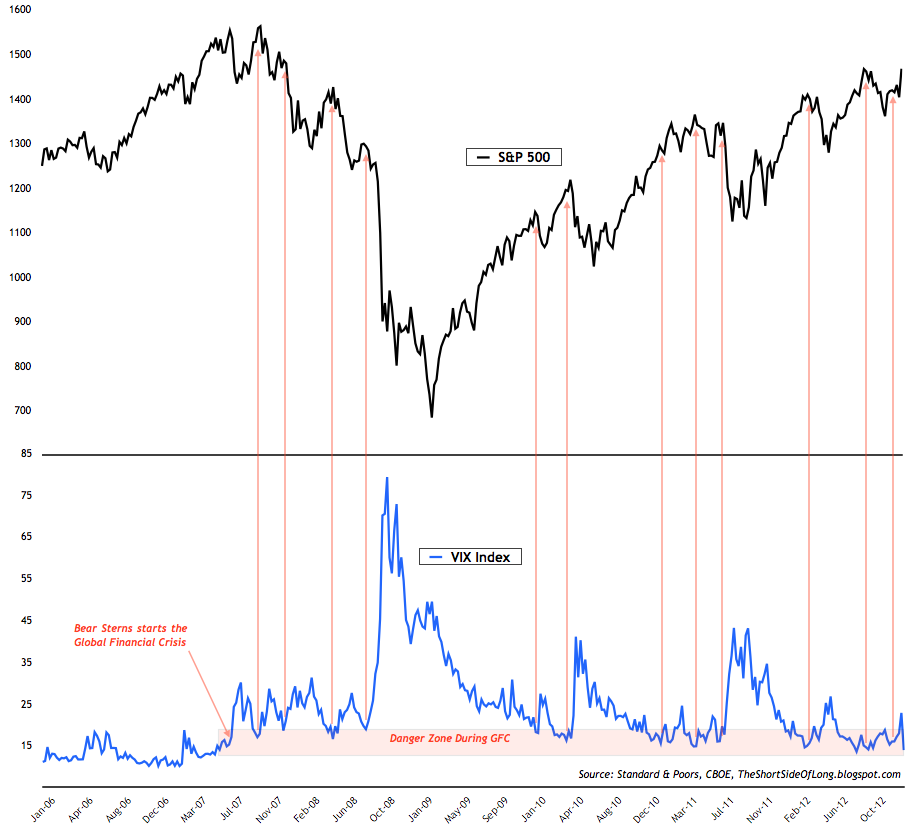

Chart of the day

Should equity investors be worried about a low VIX? (Short Side of Long, Quantifiable Edges)

Markets

Hedge funds limped to a 5.5% return in 2012. (FT, Bloomberg)

The junk bond market seems pretty played out. (WSJ, FT Alphaville)

Is this a better measure of uncertainty than the VIX? (Condor Options)

Strategy

Four big trends that are set to accelerate in 2013. (Leigh Drogen)

What matters more: total or residual volatility? (Falkenblog)

Your 401(k) plan likely sucks. (The Reformed Broker, WSJ)

Why it is so important to start saving NOW. (Bucks Blog)

Companies

Round 2: Bill Ackman vs. Herbalife ($HLF). (Bloomberg via Bronte Capital also research puzzle pieces)

Bill Gates owns a lot less Microsoft ($MSFT) than you think. (The Reformed Broker)

Is slow-follower Facebook ($FB) worthy of tech leadership? (SAI)

A look at Apple’s ($AAPL) Q1 earnings. (Asymco)

Amazon’s ($AMZN) stock is at all-time highs. (GigaOM)

The smartphone trend is just getting started. (SAI)

Finance

Doesn’t everybody already know that the big banks are “opaque, risky, and complex”? (Epicurean Dealmaker)

Chalk one up for the global banks: Basel rules eased. (FT, NYTimes, FT Alphaville, Quartz)

A company that is getting dragged kicking and screaming to an IPO. (Term Sheet)

The MBA ain’t what it used to be. (WSJ)

Funds

A day in the life of an ETF manager. (WSJ)

When does small cap indexation pay? (Minyanville)

In defense of ETF closures. (IndexUniverse)

Always beware backtested performance (including the benchmark). (Rick Ferri)

Global

The Yen is uniquely oversold at present. (Global Macro Monitor)

Investors continue to pile into emerging market junk bonds. (Quartz)

Economy

Raise your hand if you are sick of the screaming mobs of economists and political pundits. (Interloper)

How much more room does the economic expansion have to run? (Free exchange)

The economy and the financial markets are inextricably linked. (Conversable Economist)

Don’t expect a huge tick up in the labor participation rate in 2013. (Calculated Risk)

Mixed media

Web publishing is set for another revolution. (Howard Lindzon)

How cable makes money. (The Atlantic)

A review of the two books that is James Owen Weatherall’s The Physics of Wall Street: A Brief History of Predicting the Unpredictable. (NYTimes also Minyanville, Reading the Markets)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.