Quote of the day

Charles A. Czeisler, “Most of us have forgotten what it really feels like to be awake.” (NYTimes)

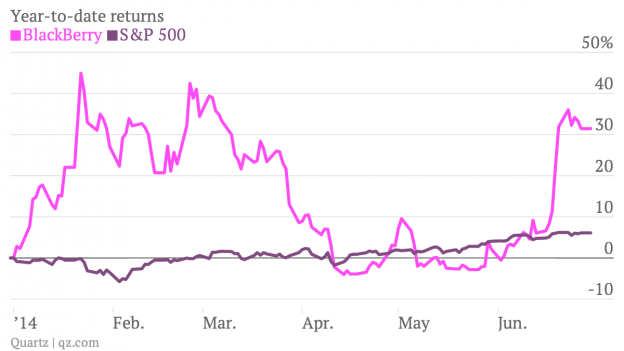

Chart of the day

You may be surprised about Blackberry ($BBRY) year-to-date. (Quartz)

Strategy

Investor sentiment is still elevated. (Short Side of Long)

Breaking down investors into three groups by behavior. (A Wealth of Common Sense)

Value stocks don’t necessarily protect you during market declines. (Greenbackd)

How to play the rise in global weather volatility. (Attain Capital)

Companies

On the coming obsolescence of broadcast television. (Recode)

Does Amazon ($AMZN) actually make money? (Peridot Capital)

Finance

The IPO market has heated up. (Business Insider)

Global M&A is at a 7-year high. (Reuters)

How SarBox and Reg FD short-circuited public markets. (A VC)

Why dark pools aren’t going anywhere. (Bloomberg also Dealbook)

Being a corporate cash manager is no easy task these days. (Sober Look)

On the power of Finance Twitter. (The Reformed Broker)

Hedge funds

Hedge funds are now highly correlated with the stock market. (FT)

Blackstone Group ($BX) is readying a “big, bold” hedge fund. (WSJ)

Funds

2014 is yet another disappointing year for stock pickers. (WSJ)

Why high active share funds tend to outperform. (FT)

Behold the return of Bill Miller to the top of the performance charts. (WSJ contra The Reformed Broker)

Economy

Why we should discount the big Q1 GDP miss. (Gavyn Davies)

The state of the US housing market. (Bonddad Blog)

Are households really deleveraging? (Dr. Ed’s Blog)

Earlier on Abnormal Returns

What you might have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

The death of e-mail newsletters has been greatly exaggerated. (NYTimes)

How Millenials define success in the workplace. (Adam Nash)

On the dangers of being too plugged in. (WSJ)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.