The active vs. passive debate has been going on as long as their has been index funds. That being said of late index funds and their supporters have been on quite a hot streak. It was recently reported that the Vanguard Group now manages over $3 trillion in assets a majority of which is in index funds.

John Rekenthaler at Morningstar poured some gasoline on the fiery debate by asking whether active management had a future. After showing the dominance of index funds Rekenthaler concluded that:

Active managers have become the periphery. As the slogan goes, there is core and then there is explore. Active management is no longer core.

Depending on how measure things passive investing is still only 36% of the equity mutual fund universe and an even smaller part of the fixed income universe. So there is still room for indexing to take market share. The irony is that Vanguard who has over $300 billion in actively managed equity mutual funds has shown strong historical performance. This is due in large part to low fees.

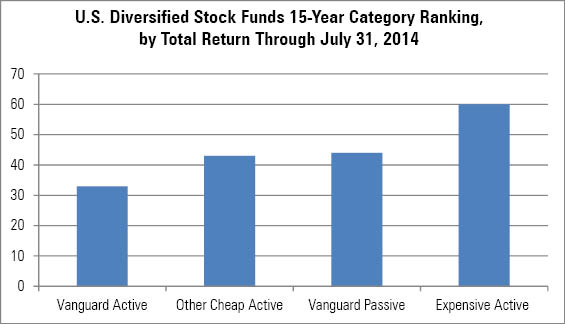

The fact is that the only factor investors can really control when it comes to selecting mutual funds (and ETFs) is fees. There is a one-for-one relationship between fees and performance. John Rekenthaler at Morningstar shows that fees play an important role in fund performance highlighting the advantage Vanguard has over its for-profit competitors.

Source: Morningstar

Morgan Housel at the Motley Fool expands on this idea of fees and extends from not only fund fees but the advisory fees investors pay to have their portfolios managed. This is just one of many things Housel things is “strange” about the financial services industry. Housel writes:

I can’t think of another industry in which there is so much ignorance around costs.Nearly all financial fees are deducted from assets automatically, rather than clients receiving and paying an invoice. This makes them out of sight, out of mind. Ask someone how much their cell phone bill is, or how much a gallon of gas costs, and they can tell you down to the penny. But ask them how much they pay in advisory fees, and they may have no clue whatsoever.

Certainly performance has something to do with this. Charles Ellis in a recent Financial Analysts Journal article talks about the harsh math of active management and the rise of index investing. This is due in part to the fact the investment industry has become increasingly sophisticated, i.e professional, over time therefore limiting the opportunity for active managers to outperform.

Jason Zweig at WSJ picks up on this theme on notes the dwindling opportunities for active managers. Ellis concludes that investment professionals should focus more on managing the client as opposed to trying to beat the market. Zweig writes:

To Mr. Ellis, the future for many portfolio managers is clear: “Lots of them are going to have to go find something else to do, because the line of work they originally trained for will be fading away.” One obvious destination, he says, is financial planning.

Financial planning and the broader idea of portfolio construction is worth noting here because in a certain sense there is no such thing as a purely passive portfolio. Every portfolio requires some management over time. Cullen Roche at Pragmatic Capitalism finds the idea of “passive portfolios” to be an oxymoron. He writes:

Now, don’t get me wrong here – a lot of the general message underpinning the concept of “passive investing” is great. I love indexing. Diversification is tremendously important. Costs are HUGELY important. Trading can be terrible for your wealth. But “asset picking” (which is what all asset allocation ultimately comes down to) is totally necessary. It’s the only way we can construct portfolios that align our risk tolerance and financial goals with a certain set of appropriate assets.

In the end we are all hopefully trying to build portfolios that meet our particular financial goals. In some cases that might very well include some actively managed funds. Russ Koesterich at the iShares Blog writes about when index (and active) funds make sense. In light of the active vs. passive debate last year I wrote about under what conditions actively managed funds might make sense. In conclusion I wrote:

The financial media not one for subtlety. The indexing=good, active=bad meme is the dominant one at present. There are some very good reasons why investors may want to try to take advantage of actively managed funds in select sectors. Provided you have the right framework and expectations this can make perfect sense. However as noted above investors should keep a keen eye on costs and recognize that we are talking about the slices of the portfolio pie, not the whole pie.

That being said we shouldn’t let the pursuit of incremental gains have us take our eyes off the ball. James Picerno at the Capital Spectator in a recent post talks about the challenges in selecting actively managed funds in building our asset allocation. The broader point he makes is that building and maintaining a rational asset allocation strategy is challenging enough without complicating it with the pursuit of alpha.

We already know that investors are prone to chasing performance. Ben Carlson at A Wealth of Common Sense highlights a recent example of extreme performance chasing on the part of investors into a fund whose strategy that most investors likely don’t understand. This very often leads to a cycle of booming asset flows and the inevitable disappointment for investors.

The big problem for investors is when they continue to cycle from bust to bust. This serial underperformance can lead to greatly diminished terminal wealth. All investors are beset by a number of behavioral biases, which focusing exclusively on index funds, will not offset. Investing is hard enough without throwing all sorts of complications on top of things.

So in the end for the vast majority of investors the active vs. passive debate is at best a sideshow. While we may think that “working harder” will generate for us better returns in reality this extra effort is more likely to cost us time and money over the long run. The things that matter the most for your portfolio, and ultimately your goals, are the big decisions we make about savings, taxes, rebalancing and asset allocation. Focusing on this big picture issues is far more important than picking amongst the latest list of five-star funds.

Items mentioned above:

Investors pour money into Vanguard. (WSJ)

Do active funds have a future? (Morningstar)

Passive investing will still gain ground. (Marketwatch)

Active vs. passive is the wrong question: cost is what matters. (Rekenthaler Report)

Finance is a strange industry. (Motley Fool)

The rise and fall of performance investing. (FAJ)

Mauboussin on “hitting .400” in today’s investing world. (Guru Investor)

The decline and fall of fund managers. (WSJ)

It’s time to eliminate the term ‘passive investing.’ (Pragmatic Capitalism)

Active vs. passive: how to blend both. (iShares)

Active pieces of the pie. (Abnormal Returns)

The active vs. passive debate has become tiresome. (Capital Spectator)

In pursuit of past performance. (A Wealth of Common Sense)

Indexing is no panacea. (Abnormal Returns)

Active vs. passive: try harder or do something easier? (Abnormal Returns)

Mutual fund ratings and future performance. (Vanguard)