Carl Richards writing at the Bucks Blog and at his own site Behavior Gap has helped popularize the idea that investors are oftentimes their own worst enemy. Buying high and selling low, therefore creating a “behavior gap” between the headline performance for various funds and investor’s actual performance. You can see below how Carl has sketched out this idea:

Source: Behavior Gap

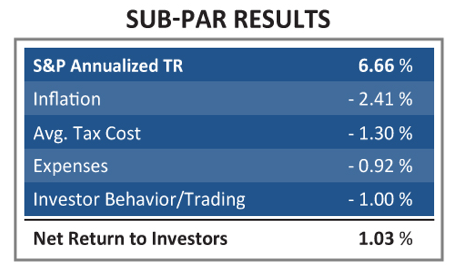

Now we have more evidence supporting this phenomenon. Gregg S. Fisher writing at Forbes highlights a study that not only documents the behavior gap but also shows the toll that inflation, taxes and expenses also take on the average investor. A 15-year example using the S&P 500 is shown below:

Source: Forbes

Some of these factors like inflation are impossible to dodge, but others are within the domain of investors. Fisher writes:

While these key detractors from investors’ bottom-line performance are not entirely surprising, it is interesting to note the extent to which the outcome here is also driven by a factor over which investors, in principle, have complete control: their own behavior. Indeed, fully one percentage point of the investor’s underperformance relative to the index can be attributed to trading activity.

The behavior gap is real, but like all biases is difficult to deal with. The first step is to acknowledge that we have a problem. The challenge is coming up with a strategy that provides a solution to our desire to unwittingly buy high and sell low.

For a more technical take:

“Past performance is indicative of future beliefs” by Philip Z. Maymin and Gregg S. Fisher, 2010/11. (Gerstein Fisher)