Quote of the day

Michael Batnick, “Make no mistake that what we’re experiencing now has literally nothing to do with global growth, earnings or valuations. Psychology is driving this market and it is truly fascinating to watch.” (The Irrelevant Investor)

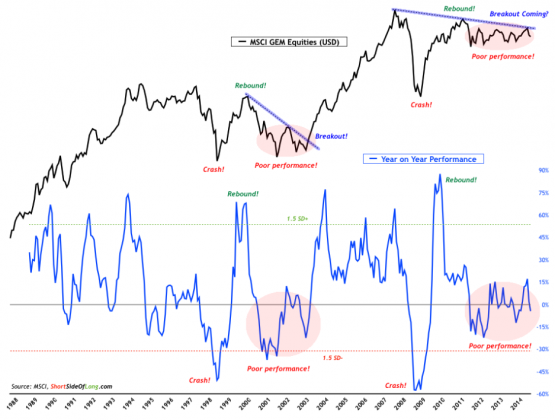

Chart of the day

Emerging market equities haven’t gone anywhere in a while. (Short Side of Long)

Markets

Ten insane things people on Wall Street believe. (The Reformed Broker)

What sectors are leading the market? (Andrew Thrasher)

Q3 earnings are doing better than sales. (Bespoke)

Market declines often create opportunities in CEFs. (InvestmentNews)

Media

Why covering the markets is so fun. (Joe Weisenthal)

Why blog, tweet, etc, about markets. (Felder Report)

29 essential feeds to follow for money and investing. (Betterment)

Strategy

Who gets information first in financial markets? (SSRN via Matt Levine)

Why you sometimes need to take a “step back” to take a clear look at your positions. (Brattle Street Capital)

Cheap stocks, as measured by the enterprise multiple, outperform. (Alpha Architect)

Companies

Seemingly all at one a bunch of American blue chips are in trouble. (The Reformed Broker, WSJ)

Will Google ($GOOG) ever be a force outside of search? (stratechery)

Finance

Blurred lines: hedge fund managers continue to push into venture capital space. (WSJ)

Mortgages

All the major players wanted easier mortgage lending rules. (Wonkblog, Dealbook, Aleph Blog)

Now buyers, who previously had defaulted, are back. (NYTimes)

Why younger Americans are renting, not buying. (NYTimes)

Funds

The SEC is says NO to non-transparent ETFs. (Focus on Funds, Bloomberg, Dealbook)

Legacy asset managers are scrambling to buy their way into the ETF business. (Reuters)

Investors are throwing money at Joel Greenblatt’s mutual funds. (NYTimes)

How to become a fund manager. (Banker’s Umbrella via @ritholtz)

Economy

Weekly initial unemployment claims are sitting at expansion lows. (Calculated Risk)

The Chicago Fed National Activity Index was strong in September 2014. (GEI)

Why rising rents have not yet pumped up inflation. (Real Time Economics, Sober Look)

Gas stations are making good money even with low gasoline prices. (MoneyBeat)

“At low wages, a smartphone-enabled human driver is formidable competition for a driverless vehicle.” (Free exchange)

Earlier on Abnormal Returns

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Google ($GOOG) is trying to re-invent e-mail. (The Verge, TechCrunch, Wired)

Free shipping isn’t free. (WSJ, Fortune)

Cheap solar power is the latest employee perk. (Scientific American, NYTimes)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.