Quote of the day

Daniel Gross, “So how is that austerity thing working for the Brits? Not so great.” (Yahoo! Finance)

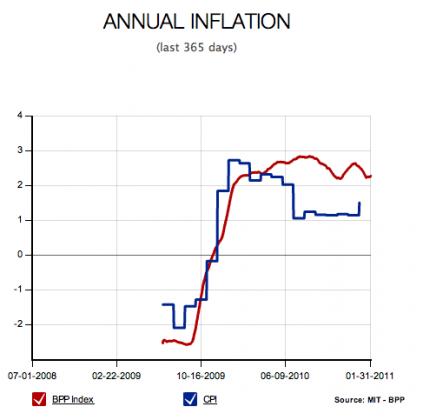

Chart of the day

What the BPP Index is saying about inflation trends. (The Reformed Broker)

Markets

A look at the VIX futures curve. (SurlyTrader)

Americans once again heart equity mutual funds. (Floyd Norris)

The Treasury is not going to issue a ‘century bond.’ (Felix Salmon)

Strategy

Michael Lewis on why you shouldn’t listen to Wall Street advice. (Tech Ticker)

Whitney Tilson is pulling in some of his short positions. (market folly, Dealbreaker)

How do you start trading a new system? (Au.Tra.Sy)

Diversification has served bond investors well. (Vanguard via @BobBrinker)

Russell’s next moves in the ETF space. (IndexUniverse)

Commodities

Jeff Carter, “When analyzing commodity markets, it’s really easy to get a handle on the supply side. Demand is not so clear. That’s really what every one that trades the market is trying to get a handle on.” (Points and Figures)

Is there a sentiment shift afoot in the natural gas market? (MarketBeat)

Commodity stockpiling is leading to price pressures. (WSJ, ibid, TRB)

Keep an eye on the supply side of copper. (beyondbrics, The Source)

Companies

What makes a hit consumer internet service, like Netflix (NFLX)? (GigaOM also Investing With Options)

The (hot) Kinder Morgan is coming back public. (Dealbook, 24/7 Wall St.)

The saga of Freescale Semiconductor. (the research puzzle)

Whom to believe in the great search controversy: Google (GOOG) or Microsoft (MSFT)? (FiveThirtyEight also Bronte Capital, Credit Writedowns)

Finance

Bethany McLean, “Steeply rising debt isn’t healthy for people, and it isn’t healthy for banks.” (Slate also Felix Salmon)

Simon Johnson, “In this context, the idea that megabanks would move to other countries is simply ludicrous.” (Economix)

Just in case you needed a reason not to trade over-the-counter derivatives with a big bank. (Boston Review also FT Alphaville)

Harry Markopolos is now targeting the big banks over forex transactions. (Deal Journal)

Global

The real value of the yuan. (Econbrowser, Free exchange)

It is impossible to talk about THE Chinese property market. (beyondbrics)

Some indicators to help explain the situation in the Middle East. (Global Macro Monitor, Money Game)

Yum! Brands (YUM) is an emerging markets powerhouse. (Money Game)

The Global X FTSE Andean 40 ETF (AND) launches. (ETFdb)

Economy

More movement on the initial jobless claims front while the ISM services index surges. (Calculated Risk, ibid)

A preview of a (noisy) January employment report. (A Dash of Insight also Money Game)

When will the balance sheet recession end? (Pragmatic Capitalism)

A conversation with Tyler Cowen. (Economix also Mandel on Innovation)

Also on Abnormal Returns

How does your work space affect your trading? (Abnormal Returns)

Weakness in the transports. Cause for concern? (Abnormal Returns)

Our Thursday morning live link look-in. (Abnormal Returns)

Mixed media

VCs are not your friends. (Fortune Finance)

Same iPhone. Different network. (Daring Fireball)

In a world of “search, aggregation and social media” does The Daily change anything? (Big Picture)

Thanks for checking in with Abnormal Returns. For all the latest you can follow us on StockTwits and Twitter.