Quote of the day

Derek Thompson, “The mechanization of the farm invented the modern U.S. economy. It made us richer, better fed, more productive, and more fully served by workers freed from agriculture. ” (The Atlantic)

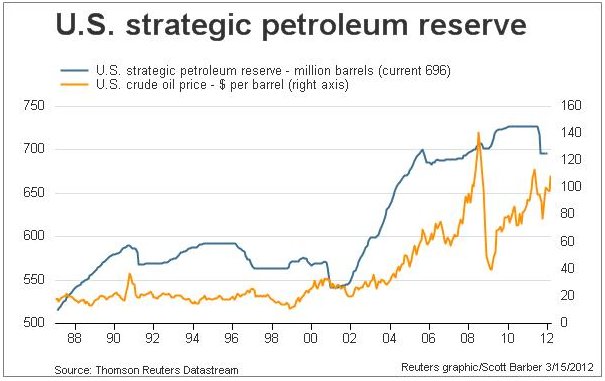

Chart of the day

The US strategic petroleum reserve over time. (Reuters via @scottybarber)

Markets

Why banks want a workable correlation product to trade. (FT Alphaville)

Stocks that Wall Street loves. (Bespoke)

Maybe we shouldn’t worry about Dow Transport weakness any more. (StockCharts Blog)

Bonds

How do you make money on TIPS at these levels? (Calafia Beach Pundit)

When will the strong economy upend the safety trade in Treasuries. (Time)

What the bond sell-off says about the stock market. (Investing With Options)

Strategy

How not to get caught up in the consensus trade. On the use of social media. (Tradestreaming)

Return dispersion seems to help predict stock returns. (SSRN via @quantivity)

Companies

Wireless networks are not really ready for the surge in data hungry devices like the new iPad. (Forbes)

Good luck trying to catch up to Amazon ($AMZN) in the cloud space. (Wired)

Is Dan Loeb now stuck in his Yahoo! ($YHOO) position? (YCharts Blog)

Why Apple ($AAPL) has so much darn cash: executive protection. (NetNet)

Square is the future of mobile payments. (Leigh Drogen)

Finance

Is the business model of Wall Street broken? (ProPublica)

Hey Goldman, “You are a giant f*cking hedge fund which has been trading for its own account for years…You don’t have clients anymore; all you have are counterparties.” (The Epicurean Dealmaker)

Why are the banks so hot to deplete their capital via buybacks and dividends? (NYTimes, Breakingviews contra Felix Salmon)

Fed stress tests as negotiating tactic. (Condor Options)

Is the Caesar’s Entertainment ($CZR) small float/fast following secondary the new wave in IPOs? (24/7 Wall St.)

Is Wall Street losing the Ivy League? (Dealbook)

Andrew Haldane goes beyond what other financial regulators here are saying. (Justin Fox)

ETFs

Available ETF options to short Treasury bonds. (Ari Weinberg)

The high dividend ETF space is getting crowded. (IndexUniverse)

One area where ETFs lag, high yield bond performance. (research puzzle pix)

A short maturity junk bond ETF is a logical extension. (IndexUniverse)

Economy

Weekly initial unemployment claims continue to trend lower. (Calculated Risk, Capital Spectator)

Regional surveys point towards more growth. (Calculated Risk, Bespoke)

Why bother with economic data when it is the revisions matter. (FT Alphaville)

Housing affordability is at a high. (Economic Musings)

Expect state pension benefits to continue to be cut. (Bloomberg)

What are “pop bonds” and how they might save governments money? (Marginal Revolution)

Karl Smith, “Apple is sort of a test case for broad theories about how the New Economy differs from the Industrial Economy in terms of rent distribution, or how the gains from productivity enhancement are distributed throughout the economy.” (Modeled Behavior)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Asia’s demographic dividend is now waning. (FT)

The world’s worst personal finance video. (Felix Salmon)

The biomechanics of running. (Wired)

Abnormal Returns is a founding member of the StockTwits Blog Network.