Quote of the day

Dustin Curtis, “The future is extremely hard to see through the lens of the present. It’s very easy to unconsciously dismiss the first versions of something as frivolous or useless. Or as stupid ideas.” (dcurtis)

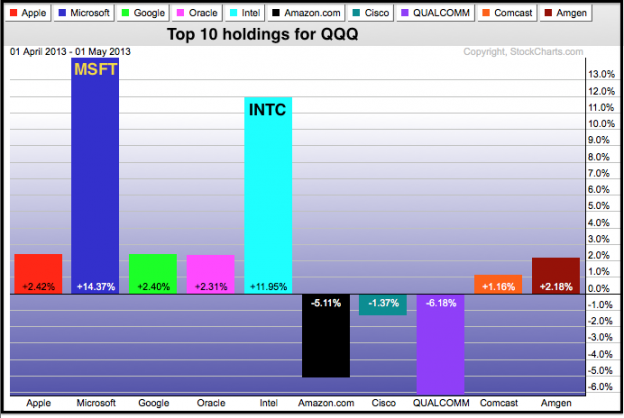

Chart of the day

The revenge of Wintel. (StockCharts Blog)

Markets

Owning the highest cap S&P 500 stock has been a historical loser. (Mebane Faber Research)

Does silver have a bounce in it? (Market Anthropology)

Americans are just not all that interested in the bull market. (MoneyBeat, Bespoke)

Strategy

Plan first: products second. (Rick Ferri)

No trader is perfect. (Schaeffer’s Research)

Why we prefer stories to cold, hard numbers. (Above the Market)

Companies

Why companies don’t want to to be public any more. (CNNMoney)

Gold miners need to start returning more cash to shareholders. (FT)

Just how much is Apple ($AAPL) going to save by borrowing cash instead of repatriating it? (FT also Income Investing)

Facebook ($FB) is aggressively investing for the future. (SAI also Wired)

Where did all the Google search traffic go? (BuzzFeed)

Hedge funds

The best hedge fund you have never heard of. (Quartz)

Tough times for the hedge fund of fund industry. (Institutional Investor)

Steve Cohen is tired of paying people who get busted for insider trading. (Reuters)

Finance

The CME ($CME) has some electronic gaps to fill. (WSJ)

Wall Street money is sloshing around the residential housing market. (Reuters)

Lending Club scores an investment from Google ($GOOG). (Dealbook, TechCrunch, Bloomberg)

No wonder crowdfunding rules are taking so long to promulgate. (Morningstar)

ETFs

A look at the Oakmark Funds manager family tree. (Mutual Fund Observer)

Bond funds are running out of bonds to buy. (WSJ, In Pursuit of Value)

Emerging Global Advisors continues to slice and dice the emerging market universe. (IndexUniverse)

Global

The ECB to no one’s surprise cut its key interest rate. (Bloomberg, Quartz, MoneyBeat)

Economy

Weekly initial unemployment claims are at their lowest level since 2008. (Calculated Risk, RTE)

A preview of tomorrow non-farm payroll numbers. (A Dash of Insight, Calculated Risk, Capital Spectator)

The Fed made subtle changes to its statement. (Tim Duy, RTE, FT Alphaville, Free exchange)

In defense of high corporate profits. (The Atlantic)

Earlier on Abnormal Returns

What books Abnormal Returns readers purchased in April 2013. (Abnormal Returns)

Mixed media

Six ways to think about statistical evidence. (Bloomberg)

How Betaworks became a “terribly fun company to watch.” (The Atlantic)

Why Kentucky Derby times have stagnated. (Quartz)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.