Quote of the day

James Surowiecki, “Still, it’s telling that the companies, like Google, that are shaping the digital world are also the ones that have invested the most in building corporate campuses outfitted with every perk imaginable. (New Yorker)

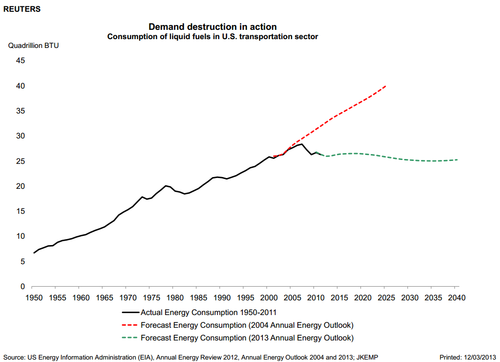

Chart of the day

Check out the changing trajectory of US fuel consumption. (FT Alphaville)

Markets

Adam Warner, “The VIX futures’ ability to predict the future is wildly overstated.” (Outside the Box)

The market is conflicted. (Phil Pearlman)

S&P 500 sector weights over time tell a tale. (Bespoke)

The gold trade is not working. (Quartz also Term Sheet)

Low vol has done well in 2013. (Falkenblog)

Strategy

Rick Ferri, “Pure passive investing does not exist, but that shouldn’t matter to passive investors. When the goal is to be the market rather than beat the market, that’s passive in my book.” (Rick Ferri)

On the high price of safety. (Above the Market)

Five new ETFs worth a look. (Morningstar)

A few notes on Quantitative Value: A Practitioner’s Guide to Automating Intelligent Investment and Eliminating Behavioral Errors, by Wesley Gray and Tobias Carlisle. (CXO Advisory Group)

Apple

Why Andy Zaky’s investors were doomed. (TheStreet earlier on Abnormal Returns)

Apple has a iPhone 5S ‘problem.’ (iMore)

What is the right analogy for the rise (and fall) in Apple ($AAPL) shares? (Market Anthropology)

Companies

Why is Alliance Resources ($ALGP) so “outstandingly good”? (Bronte Capital)

Why Hewlett Packard ($HPQ) will not go the way of Kodak. (Vitaily Katsenelson)

Time for a break-up of Smithfield Foods ($SFD)? (Stock Spinoffs)

Autos

The return of the “small” pickup is nigh. (WSJ)

Your car is about to get even more connected. (The Verge)

Finance

Can piggybacking on activist investor trades make you money? (Michael Santoli)

CEOs should eliminate the middle men when it comes to meeting investors. (the research puzzle)

Who does the Dell ($DELL) board work for? (Term Sheet)

Why Intrade closed up shop. (FT, Term Sheet, New Yorker)

Global

Where Japanese retail investors are putting their money. (FT)

The three currencies hedge funds hate at present. (Andrew Thrasher)

Is it time to buy the Pound? (The Source)

Housing

Increasing household formation will continue to push housing demand higher. (ValuePlays)

Lumber prices continue to go higher. (Carpe Diem)

Food

Why we love limited-time offers, like the Shamrock Shake so much. (Time)

The benefits has Taco Bell has seen from the “Doritos Tacos Locos. (Daniel Gross)

Bottoms up: new optimism about resveratrol. (Well, NetNet)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.