Quote of the day

Carl Richards, “Knowledge alone isn’t enough. Even though we know it’s a bad idea to buy high and sell low, spend more than we earn, or invest in only one stock, we still repeat these mistakes.” (Bucks Blog)

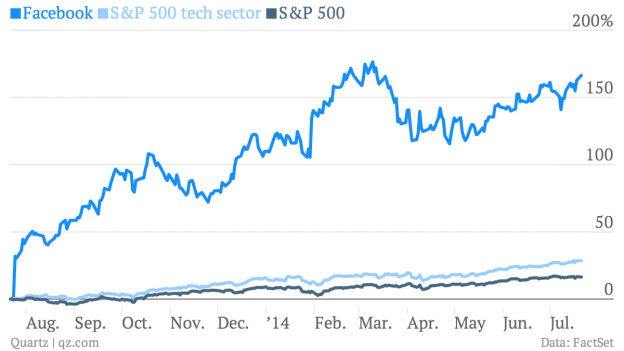

Chart of the day

Facebook ($FB) has been the best performing S&P 500 stock over the past twelve months. (Quartz)

Markets

Why Treasury yields can’t catch a bid. (Capital Spectator)

How to play the large cap-small cap spread. (Dynamic Hedge)

Checking in on some market breadth measures. (Short Side of Long)

Strategy

How to reduce portfolio risk without going to cash. (Pension Partners)

What traders have in common with climate change deniers. (The Irrelevant Investor)

Value is at best a nebulous concept. (Pragmatic Capitalism, ibid)

Why you can’t attach too much import to any single trade outcome. (Adam Grimes)

Companies

Netflix ($NFLX) now has in excess of $50 million subscribers. (TechCrunch, Buzzfeed Business, Time)

Why Amazon Prime is so important to Amazon’s ($AMZN) future. (Quartz)

America loves Chipotle ($CMG). Period. (Wonkblog also Business Insider)

Finance

Institutional investors own less than 1% of global farmland. You do the math. (Dealbook)

Tough times for global macro hedge fund managers. (WSJ)

Why boards of directors don’t typically talk to shareholders. (Dealbook)

Big companies really want to get pensions off of their balance sheets. (Wonkblog)

Loans

Junk-rated loans are getting even junkier. (Bloomberg)

While banks report the lowest loan losses in eight years. (FT)

ETFs

Investors are fleeing core bond funds for more exotic fare. (Morningstar)

How to avoid four common ETF trading errors. (ETF)

Global

Russian stock weakness is all the more notable because the emerging markets are rising. (Macro Man)

Low US corn prices have global effects. (Globe and Mail)

Economy

Why now is the time for business to really begin spending again. (The Upshot)

Millennials could use a good dose of inflation. (Money)

Food prices are just not rising all that much. (Pragmatic Capitalism)

Why consumers tend to misjudge inflation. (Econbrowser)

Earlier on Abnormal Returns

An excerpt on bond ETFs from William Bernstein’s Rational Expectations: Asset Allocation for Investing Adults. (Abnormal Returns)

What you might have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Four ways to rediscover your motivation. (Fast Company)

The Swedes burn garbage for energy. Why can’t we? (Daniel Gross)

Adam Rogers’ new book Proof: The Science of Booze is a “lively, new survey” of the world of alcohol. (NYTimes)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.