Quote of the day

Bryan Goldberg, “The secret of SEO is to… create content that people want to read. That’s it. That is the deep, dark secret.” (Pando Daily)

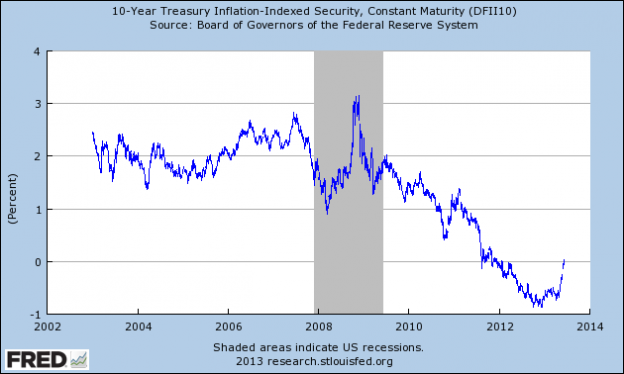

Chart of the day

TIPS yields have turned positive. (The Tell, Crossing Wall Street)

Bonds

Investors are fleeing bond funds. (Quartz)

How to take advantage of bargains in muni bond CEFs. (Morningstar)

The bad news of rising real yields. (Buttonwood)

Shorts are jumping on high yield bond ETFs. (Focus on Funds)

Markets

Equities are the new bonds and bonds are the new equities. (David Rosenberg)

Discount brokers are rallying. Is that a good sign? (Bloomberg)

It’s time for the cyclicals to start outperforming. (Charts etc.)

REITs look rich. (Institutional Imperative)

The market’s PEG ratio is pretty much in line with historical averages. (Dr. Ed’s Blog)

Emerging markets

Emerging markets are tanking. (Money Game,

Are emerging market uniquely liquidity-driven? (MoneyBeat)

On the chance of a reversal. (Dragonfly Capital)

A number of overseas markets look none too hot. (The Short Side of Long)

Strategy

The real underpinning of the global equity markets. (Gavyn Davies)

Is the AAII survey a contrarian indicator? (Greenbackd)

Why is Vanguard such an ‘anomaly’ in the fund world? (Rekenthaler Report)

Savings

Start saving now! (Vanguard)

We need a new retirement savings system. (Helaine Olen)

Your two investing goals in retirement. (Monevator)

Technology

Reactions, largely positive, to Apple’s ($AAPL) “confident” announcements at WWDC. (The Loop, Quartz, Pando Daily, GigaOM, Daring Fireball, The Wirecutter)

It’s now Apple’s turn to “borrow from” Microsoft ($MSFT). (Slate)

What kind of innovative does Apple need to be? (Justin Fox)

The future of maps is social as Google ($GOOG) closes the Waze deal. (NYTimes, AllThingsD)

Finance

Funding costs are super low but finding assets to buy is difficult. (FT)

Shady brokers are getting their slates cleaned. (Dealbook)

Thinking about different ways to fund renewable energy. (Institutional Investor, Bloomberg)

The IPO window is open for PE-backed firms. (peHUB)

Does the small cap market need wider tick sizes to survive? (peHUB)

Global

Putting an estimate on world shale oil reserves. (FT, ibid)

The shift from oil to natural gas is now inevitable. (Reuters via Money Game)

Don’t mention the ‘R-word’ in Australia. (FT Alphaville)

Economy

Are higher mortgage rates affecting housing? (Sober Look)

The private economy is doing just fine. (Todd Sullivan)

Small businesses are finally turning a bit more optimistic. (Calculated Risk)

Mixed media

On the challenges of quitting coffee. (WSJ)

Chances are you are washing your hands incorrectly. (The Atlantic)

How critical all the early years of life? (Marginal Revolution)

Why learning to swim is so important. (Well)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.