Quote of the day

J.J Abodeely, “The last 10 years has demonstrated the importance of remaining vigilant and keeping our eye on the true “natural” benchmark of earning absolute returns without being exposed to catastrophic o4 permanent losses of capital.” (Value Restoration Project)

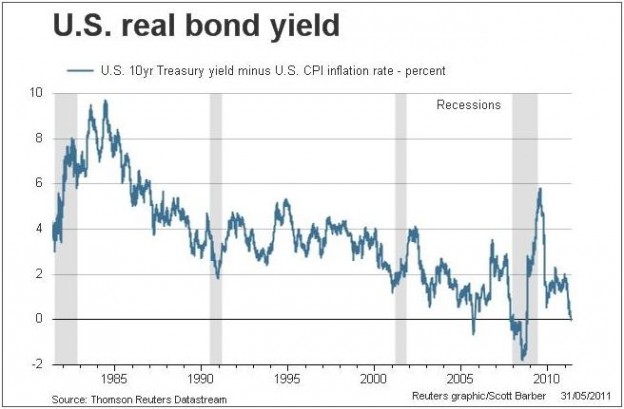

Chart of the day

The real yield on the 10-year Treasury bond is essentially zero. (FT Alphaville)

Video of the day

Consuela Mack talks with Lubos Pastor about the long term risk of equities. (WealthTrack)

Bonds

Bonds in May, winning. (MarketBeat)

The bond bull vs. bear debate. (Fundmastery Blog)

Why are gilt yields so low? (The Source)

More talk of an intentional technical default on US debt to force further budget reductions. (Money Game)

Markets

The disconnect between the economy and earnings. (Money Game)

What happens after a stock drops 25% in a week. (My Simple Quant)

A look at gap-up openings in the SPY. (Global Macro Monitor)

On the rise of beta. (Humble Student of the Markets)

What the “ultimate stock pickers” are buying and selling. (Morningstar)

Commodities

Agriculture is underpresented in world equity markets. (All About Alpha)

The copper inventory mystery. (BBC via FT Alphaville)

Cushing, OK is at risk of losing its exalted status as premier oil hub. (WSJ)

Companies

What Apple’s ‘iCloud’ exactly? (TechCrunch)

Google (GOOG) stock is at a critical juncture. (StockCharts Blog)

The end of nuclear power in Germany and its effect on solar stocks. (Climateer Investing)

One big tech stock, EMC (EMC), that is not stuck in a high cash ghetto. (The Reformed Broker)

Funds

Why aren’t there futures on ETFs? (Points and Figures)

Never judge an ETF by its cover. (ETFdb)

Money market fund managers continue to waive fees to maintain stable NAVs. (FT)

Finance

The case for Goldman Sachs (GS) stock. (Money Game, MarketBeat)

Hedge fund investors are a fickle lot, or are they? (Dealbreaker, Term Sheet)

Will the Mets be a distraction to David Einhorn? (Dealbook)

The flipside of LinkedIn (LNKD). Are banks overpricing IPOs? (Dealbook contra FT, SAI)

Global

The Euro was always doomed. (Market Anthropology)

Maybe Europe needs a dose of the “Swedish model.” (Free exchange)

Russia hikes interest rates. (NYTimes, Bloomberg)

A look at recent Mexican peso strength. (Minyanville)

On the structural challenge of inflation to the emerging markets. (beyondbrics)

China needs water, and BTUs to boot. (Confessions of a Macro Contrarian, beyondbrics)

Economy

Big drops in the Chicago PMI. (Bespoke, Calculated Risk, Real Time Economics)

New lows for the Case-Shiller home price index. (Calculated Risk, Bespoke, Big Picture)

Comparing commercial real estate indices. (Richard Green via Mark Thoma)

Where the excess vacant housing is on a state-by-state basis. (Calculated Risk)

How Q2 weakness might affect Fed policy. (Economist’s View)

The weak employment rebound in one graph. (Big Picture)

Earlier on Abnormal Returns

A renewed focus on the Andean nations as they merge their stock exchanges. (AR Screencast)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

On the value of reading widely in becoming an unconventional investor. (Expected Returns)

Some preliminary results from the “Startup Genome Project.” (From the Crowd)

The value of a 70-year software engineer. (Freakonomics)

Abnormal Returns is a founding member of the StockTwits Blog Network.