Quote of the day

Kit Juckes, “The reality is that we are short of things to worry about and long of liquidity which tends to weaken the resolve of any bear.” (Money Game)

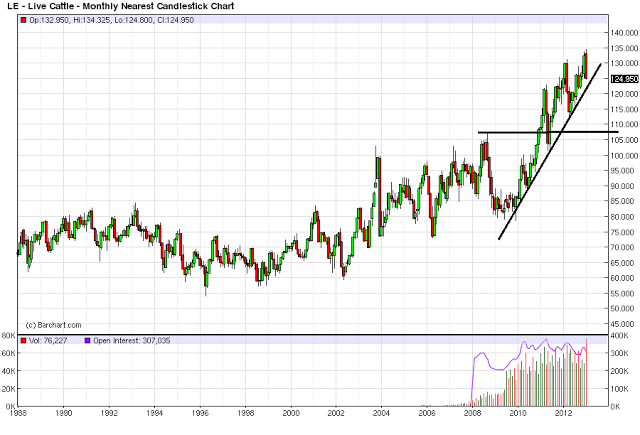

Chart of the day

Always a bull market somewhere. Cattle prices are near 25-year highs. (Bonddad Blog)

Markets

German and US investors are getting optimistic on equities. (Bloomberg, ibid)

Everybody is getting bullish all at once. (Money Game, Businesweek)

Why the $VIX isn’t all that low. (Adam Warner)

The market doesn’t care what you think. (Rick Ferri)

Beware the tax-talk hype on muni bonds. (Learn Bonds also InvestmentNews)

Fund flows

Don’t get too excited about inflows into equity mutual funds. (AlphaNow)

Investors can’t get enough Euro junk, bond funds that is. (FT)

Strategy

Why isn’t technical analysis taken more seriously? (Phil Pearlman, All Star Charts, TRB)

Howard’s nine lessons for investing. (Howard Lindzon)

What is Phil Mickelson thinking? (Big Picture updated ESPN)

Why you should be careful of “special treatment” from your broker. (Interloper)

Companies

US companies are once again using buybacks to boost EPS. (WSJ)

Could Apple ($AAPL) earnings actually drop tomorrow? (Bloomberg, Reuters also Term Sheet)

The predicament facing Samsung. (Chris Dixon)

Finance

How Goldman Sachs ($GS) beat the Volcker Rule. (Term Sheet)

Secondary buyouts are the new IPO. (Sober Look)

Funds

Options on ETFs are becoming a big business. (Condor Options)

Flaw or feature: target-date mutual funds cannot play “catch up.” (WSJ)

Did the battle over copper ETFs scuttle their chance for success? (Institutional Investor)

Three important ETF fee wars. (IndexUniverse)

Global

The Bank of Japan has set a 2% inflation target, just not yet. (FT Alphaville, Quartz, Money Game)

The Philippines economy may have turned a corner. (Quartz)

Talk of global currency wars is overblown. (Felix Salmon)

Economy

The three most likely sources of the next recession. (Calculated Risk)

The Chicago Fed National Activity Index for December shows continued moderate growth. (Capital Spectator)

A look at the booming North Dakota economy. (research puzzle pix)

Single variable analysis doesn’t work in a multi-variate world. (A Dash of Insight)

Mixed media

Are annotations the new comments? (Felix Salmon)

LEDs are becoming the new green light bulb. (NYTimes)

It’s time for Apple to get over skeuomorphs. (Scientific American)

Craft beer continued to take share in 2012. (Money & Co.)

Salmon farmers are going vegetarian. (FT)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.