Quote of the day

Barry Ritholtz, “The US banking sector is not healthy.” (Big Picture)

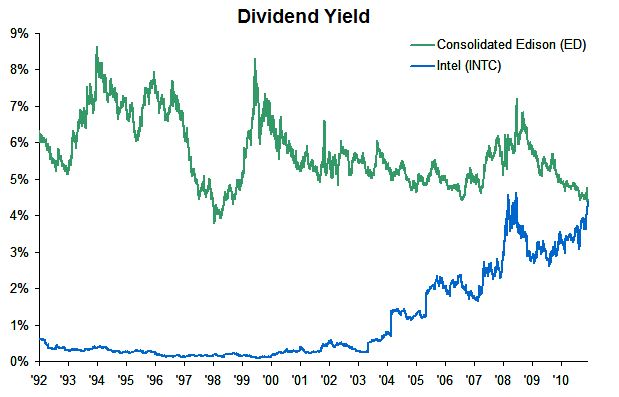

Chart of the day

Intel ($INTC) has a higher dividend yield than Consolidated Edison ($ED). (Ticker Sense)

Markets

The market seems to be tracing out a higher low. (Crossing Wall Street, TheArmoTrader)

Is the Brazilian stock market down 25% a buy? (FT Tilt)

ETF investors are just as nervous as mutual fund investors. (IndexUniverse)

How long before so-called ‘double-decker funds‘ come to the US? (WSJ)

Strategy

There is not one beta, but many betas. (All About Alpha)

On the importance of trend following. (Pragmatic Capitalism)

The nuance behind the practice of portfolio rebalancing. (ETF Replay)

What capitulation looks like. (DowntownTrader)

Unconventional wisdom

Commission-free ETFs are not necessarily cheap. (Wealthfront)

Individual investors has some very real advantages over professional investors. (Minyanville)

Don’t believe the hype from system salesmen. (Peter L. Brandt)

Why writing headlines about market action is a suckers game. (A Dash of Insight)

Companies

Product momentum is now more important than ever in the tech sector. (NYTimes)

Kindle Plus: how Amazon ($AMZN) could create a viable competitor to the iPad. (Slate)

The regulations surrounding mobile payments is exceedingly complicated. (Felix Salmon)

Caterpillar ($CAT) as a bellwether for global growth. (research puzzle pix)

Finance

Why bank stock prices matter. (NetNet also FT Alphaville)

NYSE vs. Nasdaq for the big tech IPOs. (Institutional Investor)

Complex products work for the banks, but not their customers. (Expect[ed] Loss)

What goes on behind the scenes when a broker leaves a firm. (I Heart Wall Street)

Global

Japan is pulling out some unconventional tools to offset the strong Yen. (WSJ, HuffPo, The Source)

China has had enough of the Euro. (The Source)

What the case of Italy tells us about the Eurozone crisis. (Curious Capitalist)

The global economy could take any number of diverging paths. (Deus ex Macchiato)

Economy

Where QE2 went off the rails. (FT Alphaville)

Durable and capital goods orders don’t point toward a recession, yet. (Capital Spectator, CBP)

The Baltic Dry Index is showing signs of life. (MarketBeat)

Earlier on Abnormal Returns

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Too bad the country of Greece isn’t earning royalties off increasingly popular Greek yogurt. (Atlantic Business)

Feeling a bit chunky? Blame the bear market. (LiveScience)

Abnormal Returns is a founding member of the StockTwits Blog Network.