Quote of the day

Eli Radke, “The market is not your friend, it is here to run a business. It makes business decisions. Act accordingly.” (TraderHabits)

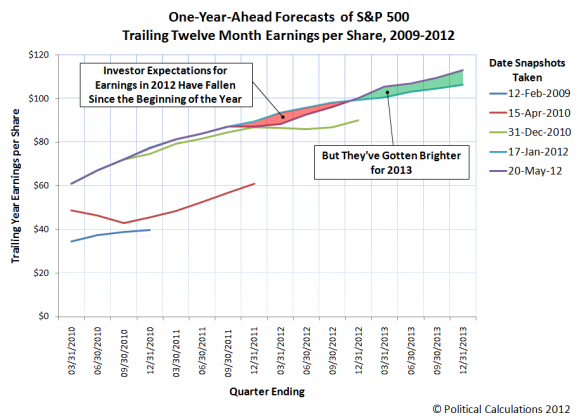

Chart of the day

Analysts are marking up 2013 earnings estimates. (Political Calculations)

Markets

Another sentiment measure displays severe risk aversion. (FT Alphaville)

One big reason why the pullback may not be over. (Dragonfly Capital)

Corporate insiders have stepped up their buying. (Mark Hulbert)

Global

30-year German bunds are trading below 2.0%. (MarketBeat)

Keep an eye on Shanghai as a tell. (Dynamic Hedge)

The Indian rupee is getting crushed. (FT Alphaville)

Strategy

Michael Covel talks with Hedge Fund Market Wizards author Jack Schwager. (Trend Following)

Rich guys think investing is easy. (Above the Market)

How to think about equal-weighted strategies? (Morningstar)

What macro bets does David Einhorn have on at the moment? (The Brooklyn Investor)

Is peer-to-peer lending a viable asset class? (Tradestreaming)

Research

Do commodity index investors affect agriculture prices? (Econbrowser)

More recent measures of book value matter for value-based strategies. (Turnkey Analyst)

How uninformed is trading? (SSRN)

A look at the minimum variance portfolio? (iShares Blog)

On the uncertain value of using dividend yield. (Greenbackd)

Companies

Ford ($F) is once again investment grade and the auto industry is downright giddy. (CNN, Real Time Economics)

Are railways the new petroleum play? (Globe and Mail)

Chesapeake Energy ($CHK) has not learned the lessons of Enron. (Breakingviews)

The warning signs were there for anyone buying the Facebook ($FB) IPO. (Jeff Matthews also Cassandra Does Tokyo)

Who is to blame for the Facebook fiasco? Pretty much everyone. (Felix Salmon)

Is Morgan Stanley ($MS) going to skate on the question of Facebook disclosures? (The Reformed Broker)

Why people got burned by Facebook? Greed. (Kid Dynamite)

Has social networking supplanted real innovation in Silicon Valley? (Slate)

Finance

Should short sellers be required to disclose their positions? (Dealbook)

Evidence suggests big banks are less efficient at credit creation than small banks. (NYTimes)

On the dangers of fully automated markets. (socializing finance)

ETFs

101 lessons everyone should learn about ETFs. (ETFdb)

ETFs as a ‘disruptive technology.’ (ETF Trends)

Ugh. Leveraged dividend ETNs. (Focus on Funds)

22 people you need to follow on Twitter who cover ETFs. (ETFdb)

The big, market cap weighted emerging market ETFs may not be the best for everyone. (IndexUniverse)

Economy

New home sales have bottomed. (Calculated Risk also Value Plays, Real Time Economics)

100 million Americans don’t have jobs. (Crossing Wall Street)

College graduates now make up a majority of the unemployed. (The Atlantic also Felix Salmon)

Trucking volume is up 3.5% year over year. (Calculated Risk)

Earlier on Abnormal Returns

Parts one and two of our discussion with Nardin Baker on the low volatility anomaly. (Abnormal Returns, ibid)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

In corporate America the word “innovation” has lost a lot of its meaning. (WSJ)

Yeah! A new ‘radically simplified’ WordPress is on the way. (paidContent)

Happy second blogiversary! (Dragonfly Capital)

Abnormal Returns is a founding member of the StockTwits Blog Network.