You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Charles Bilello, “Overall, most investors would do well to ignore the allure of “stock picking” and any notion that they have an innate ability to pick winning stocks.” (Pension Partners)

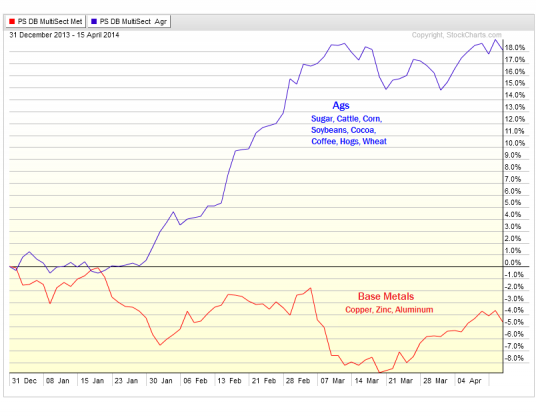

Chart of the day

Commodities do not all move in lockstep. (All Star Charts)

Markets

Is the IPO market signalling a top? (Barry Ritholtz)

Valuation and the spectrum of returns. (Meb Faber)

Remember the “Rule of 20“? (Bloomberg)

A look at the correction across sectors and markets. (VIX and More also Dragonfly Capital)

If you know where the 10 year is going…. (Market Anthropology)

How much longer will the credit market party last? (FT Alphaville)

PE and VC

Private equity fundraising is going gangbusters. (MoneyBeat)

Private equity vs. venture capital: on the mix of luck and skill. (SSRN via @jasonzweigwsj)

There is a big difference between managing small vs. large funds. (A VC)

Companies

On the remarkable transformation of Apple ($AAPL) stock. (Millenial Invest)

Yahoo’s ($YHOO) provides a window on very strong Alibaba earnings. (Dealbook, WSJ)

Can anybody catch up to Amazon ($AMZN) in the cloud? (Quartz)

Investors are reassessing the prospects for Weibo. (Quartz, FT)

The cloud and SaaS has a long way to go to take over the enterprise. (Fortune)

The problem with paying employees with shares. (Breakingviews)

Finance

Joseph Stiglitz doesn’t have much good to say about HFT. (Felix Salmon also Real Time Economics)

Noah Smith, “Flash Boys: A Wall Street Revolt is an excellent book. It’s fun and readable.” (Noahpinion)

Is Goldman Sachs ($GS) ready to pull the plug on Sigma X? (WSJ)

Matt Levine, “The more a company complains about naked short sellers driving down its stock price, the more worried you should be.” (Bloomberg)

Investment bank Moelis ($MC) struggled to go public. What next? (WSJ, Bloomberg, Dealbook)

Funds

When bloat becomes a problem for fund managers. (research puzzle pix)

The ETF Deathwatch for April 2014. (Invest with an Edge)

Global

Asset managers are the new banks. (Businessweek)

GDP is a flawed statistic only takes you so far. (John Kay)

Economy

The housing market is getting off to slow start this Spring. (Calculated Risk, WSJ)

Industrial production is headed higher. (ValuePlays, Calculated Risk, Bloomberg)

Has US inflation bottomed? (Sober Look)

More signs the labor market is tightening up. (Business Insider)

Connectivity need not equal productivity. (Salil Mehta)

Lower capital market returns is the solution to income inequality. (Matthew Klein)

Earlier on Abnormal Returns

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Five tips for talking about money at cocktail parties. (ETF)

Why you should turn off financial television. (Brian Lund)

More reasons to skip finance blog comments. (Aleph Blog)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.