You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Ben Horowitz, “Until you generate cash, you must heed investors even when they are wrong. If investors wake up one day and think you are toast, you are indeed toast. When you generate cash, you can respond to silly requests from the capital markets…” (Ben Horowitz)

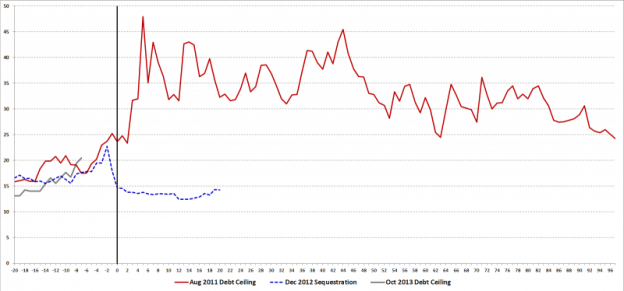

Chart of the day

Look what happened to the $VIX the last time the US pushed up against the debt ceiling. (VIX and More)

Markets

T-bill investors are getting nervous about a government default. (Wonkblog contra Felix Salmon)

Rallies end on good news, not bad. (The Reformed Broker)

The stock market is getting oversold, or is it? (Dynamic Hedge contra The Short Side of Long)

Why isn’t gold catching a bid? (Focus on Funds)

Mortgage REITs are having a tough time of it. (Marketwatch)

Strategy

Why investors should pay more attention to taxes. (Morningstar)

What do endowments believe about their alternative assets? (SSRN)

How has Sy Harding’s seasonal timing strategy done over time? (CXO Advisory)

Why the iPath S&P 500 VIX Short-Term Futures ETN ($VXX) is such an awful investment. (Inside Investing)

Companies

KFC’s same-store sales in China are plunging. (Businessweek)

Why Google ($GOOG) funded anti-aging startup Calico. (Term Sheet)

Finance

Twitter’s IPO document is surprisingly “mature.” (Dealbook)

How the Zulily IPO compares to Twitter’s. (Geekwire, Pando Daily, WSJ)

Startups

The venture capital industry is bifurcating. (Pando Daily)

What do VCs think about crowdfunding? (Venture Capital)

The number of syndicates on AngelList is growing. (WSJ)

Finance

Investment bankers are decamping from New York for lifestyle reasons. (WSJ)

2013 has been a good year for activist investors. (II Alpha)

The institutionalization of hedge funds was inevitable. (FT)

The CME Group ($CME) is taking on the LME in the aluminum market. (WSJ)

Funds

Why is picking active domestic equity managers so difficult? (Rekenthaler Report)

All bond ETFs are not created alike. (Capital Spectator)

Global

Investors can’t get enough distressed European assets. (Quartz)

Five countries with bonds safer than the US. (Brett Arends)

Economy

Janet Yellen nominated to be chair of the Federal Reserve. (NYTimes, Daniel Gross, Wonkblog, Bloomberg, The Guardian, Capital Spectator, Real Time Economics)

Yellen is going to lead a Fed that is unable to speak with one voice on QE. (Tim Duy)

Who would benefit from a US government debt default? (Janet Tavaokoli)

Earlier on Abnormal Returns

The most important charts in the world. (Business Insider)

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Beverages

Starbucks ($SBUX) wants to be big in the juice business. (LA Times)

AB Inbev ($BUD) is still having a hard time using the Budweiser name around the world. (Quartz)

The government shutdown is putting a crimp in the craft brewing industry. (AP/Yahoo!)

Gadgets

Should you upgrade to the new Kindle Paperwhite? (WSJ, Wired)

Jony Ive designed a beautiful one-off Leica camera. (Wired)

The Kindle Fire HDX is not a fully featured tablet. (AllThingsD)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.