Quote of the day

Jacob Goldstein, “People have always worried that the market isn’t fair, but as high-frequency trading took off, those worries only seemed to increase…People scared away by a market that seems unfair or incomprehensible are missing out on those tremendous gains.” (NYTimes)

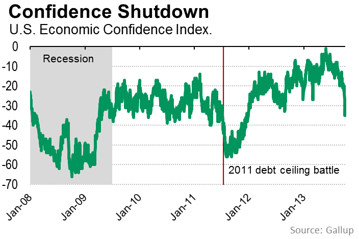

Chart of the day

Say goodbye to economic confidence. (MoneyBeat)

Markets

What has been the performance of the 100 largest 100 ETFs year-to-date? (ETF Replay)

Is Washington to blame for market weakness? (Bonddad Blog)

The $VIX is at a three-month high. (Crossing Wall Street also Quantifiable Edges)

Market breadth is weakening. (The Short Side of Long)

Strategy

Just a reminder that Congress is bad for the stock market. (Horan Capital)

A look at the performance of the “flexible asset allocation” regime. (Empiritrage)

Why you have to verify data before using it. (Portfolio Probe)

How a bond manager things about risk (and return). (Inside Investing)

Twitter

The many ways in which Twitter ($TWTR) and Facebook ($FB) differ. (Fast Company, Breakout)

Why is Twitter mucking about with “adjusted EBITDA“? (Term Sheet)

Was the Facebook IPO truly a “disaster”? (Dan Primack)

Non-news flash: Twitter sells your data. (Time)

Finance

Should the big money managers be regulated as “systematically important” institutions? (MoneyBeat, FT Alphaville)

The process of hiring external managers is broken. (Pension Pulse)

Hedge fund administrators are getting squeezed on fees. (Institutional Investor)

ETFs

High fees have in many cases eaten up all the gains made by managed futures funds. (InvestmentNews)

Do publicly traded fund managers do a better job? (Rekenthaler Report)

Are bank loan funds now overowned? (InvestmentNews)

Has the small cap premium disappeared? (IndexUniverse)

Economy

Congress needs adult supervision: time for the stock market to step in. (Rational Irrationality)

The Fed had a rough time coming to a decision in September. (WSJ, Slate)

Earlier on Abnormal Returns

106 finance people you need to follow on Twitter. (Business Insider)

What you may have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

It’s hard not to recommend the iPhone 5S. (GigaOM)

Location matters: where people on Facebook found their spouses. (BuzzFeed)

The world needs a ‘rocket tax.’ (Quartz)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.