Quote of the day

Tim Richards, “Our view of the world is dichotomous, it’s either all bad or all good and when our beliefs about our levels of control are breached we swing from high to low.” (The Psy-Fi Blog)

Chart of the day

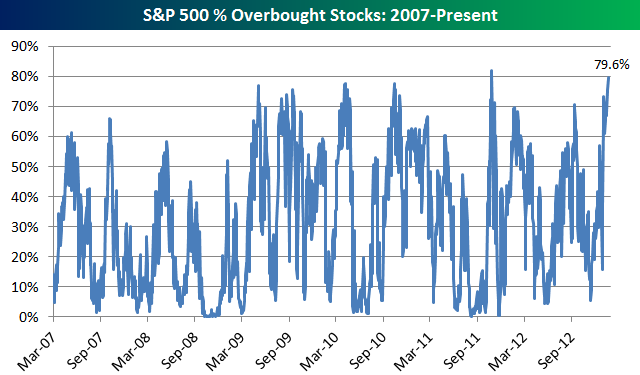

The S&P 500 doesn’t get much more overbought than this. (Bespoke, ibid)

Markets

More signs that sentiment is getting a bit elevated. (Institutional Imperative, Phil Pearlman)

Why David Tepper is (still) bullish. (Market Folly)

Everybody hates bonds. (Bianco)

Five reasons to be cautious on equities. (Sober Look)

Transports have been unusually strong of late. (Bespoke)

Strategy

Brian Lund, “The only edge you have in the market; the only true, sustainable edge you have is your ability to set and follow your rules.” (bclund)

Why investors continue to invest in hedge funds. (Bucks Blog)

Broadening out the global asset class menu. (Capital Spectator)

Americans treat their 401(k) plans like piggy banks. (Time)

Why are FX options so cheap? (SSRN)

Companies

Traveler’s ($TRV) is not shy about buying back shares. (Avondale Asset, Aleph Blog)

What might a true ‘Google Phone‘ look like? (Quartz)

Why Amazon ($AMZN) wants to get its inventory to close to you as possible. (Wired)

Microsoft ($MSFT) has too much cash on its hands as talk swirls of its participation in a Dell ($DELL) buyout. (GigaOM, Bloomberg, Dealbook, Term Sheet)

Finance

The US asset management industry has a problem. (FT)

US companies’ foreign cash isn’t all that foreign. (WSJ)

Pension funds have gone too far on the bond front. (Big Picture)

Taxation in carried interest is once again on the table. (Dealbook)

The exchange business is in serious decline. (FT Alphaville)

Global

The WisdomTree Japan Hedged Equity Fund ($DXJ) is pulling in assets at a rapid rate. (IndexUniverse)

Just in case you forgot China’s banking system is still overleveraged. (FT Alphaville, Quartz)

Internet access is the new infrastructure. (Quartz)

Behold the OPEC of tea. (The Telegraph)

Economy

Good news on the housing permit front. (Bonddad Blog)

Keep an eye on truck traffic in Q1. (Money Game)

Earlier on Abnormal Returns

Some lessons learned from some of the best Wall Street-themed movies. (Amazon Money & Markets)

Mixed media

The unlikely friendship between Baltimore’s Michael Phelps and Ray Lewis. (Washington Post)

News you can use: how to efficiently sort socks. (kottke)

Why we should not recreate/clone Neanderthals. (Marginal Revolution)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.