Quote of the day

Warren Buffett, “Money will always flow toward opportunity, and there is an abundance of that in America.” (Berkshire Hathaway)

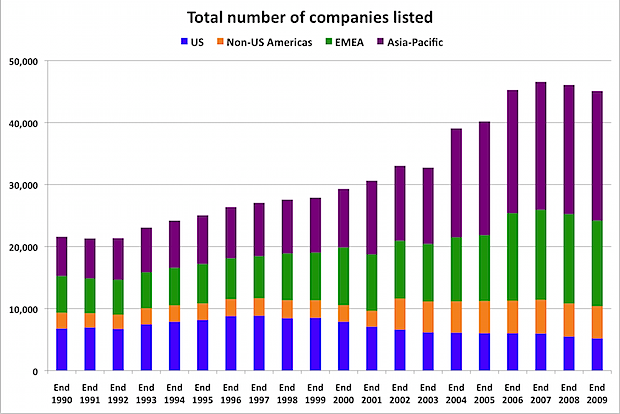

Chart of the day

The US is a shrinking part of the global listing pie. (Felix Salmon)

Markets

Uh oh. “Sheepish bulls” are getting back into the stock market. (WSJ)

Market sentiment at week-end. (Trader’s Narrative also Calafia Beach Pundit)

A sense of caution, except for energy, in the sector charts this week. (Dragonfly Capital)

Oil is the most overbought since 1999. (Bespoke)

March is poised to be volatile on the macro front. (Money Game)

Strategy

Putting the matter of P/E ratios into perspective. (Derek Hernquist)

Is the age of quality stocks finally here? (Barron’s)

The freedom to trade comes at a costs. (The Reformed Broker)

Managing risk vs. making the call: what matters most for a trader? (Finance Trends Matter)

The math behind the reopening of the Market Vectors Egypt ETF (EGPT), whenever that happens. (IndexUniverse, Kid Dynamite)

Berkshire Hathaway (BRKA/BRKB)

A look at Berkshire’s results: Burlington Northern is a highlight. (WSJ also Aleph Blog, Horan Capital Advisors)

Reactions to the Warren Buffett-penned annual shareholder letter. (Pragmatic Capitalism, Kid Dynamite, Deal Journal)

Warren Buffett is on the look out for more megadeals. (Dealbook, Street Sweep)

Checking in on Buffett’s big, long term, short put position. (Fortune Finance)

Warren Buffett has a friend in the Fed. (Dealbook)

Berkshire Hathaway as a measure of the state of the US economy. (Real Time Economics)

Buffett on the coming recovery in housing. (Calculated Risk)

Finance

Growing competition in bond ratings. Add Kroll Bond Ratings to the list. (NYTimes)

The ten most systematically risky financial firms in the US. (voxEU)

A mutual fund with a negative expense ratio?!? (CBS Moneywatch)

Technology

How long before Amazon (AMZN) starts handing out Kindles for free? (The Technium via kottke)

Howard Lindzon, “I am not bothered by Facebook’s valuation. Momentum happens.” (Howard Lindzon)

Justin Paterno, “I’ve never seen a company with so much competition coming from so many angles. These days, it’s tough being Google (GOOG).” (Justin Paterno)

Groupon’s fantastic growth. (Fund My Mutual Fund)

Russia

The Russian stock market as a not-so stealth oil play. (the research puzzle)

Russia still trades at a significant discount to other emerging markets. (Barron’s)

Economy

The dilemma higher oil prices pose for central banks. (naked capitalism)

More on the deflationary effect of higher oil prices. (Pragmatic Capitalism)

The divergence between oil and natural gas prices reflects their different consumption patterns. (NYTimes)

Earlier on Abnormal Returns

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Our Saturday long linkfest. (Abnormal Returns)

Errata

Some statistics on the movie popularity and the Oscars. (William M. Briggs via Flowing Data)

Thanks for checking in with Abnormal Returns. For all the latest you can follow us on StockTwits and Twitter.