Quote of the day

Mike Bellafiore, “Trading is not the place to come and work out your personal demons.” (SMB Training)

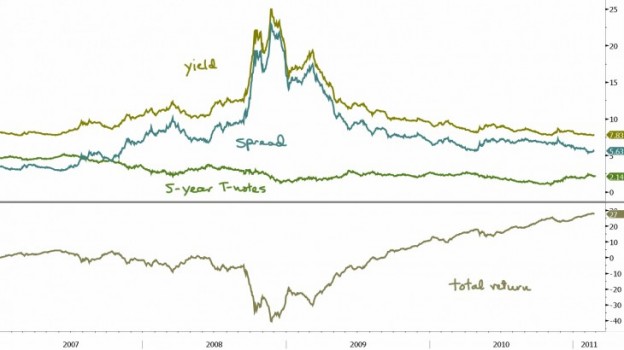

Chart of the day

A look at the sharp rise and long decline in junk bond spreads. (the research puzzle)

Markets

How have some ‘flight-to-safety‘ assets performed YTD? (VIX and More)

Despite its rise, Brent has problems with its benchmark as well. (WSJ)

The futures curve is not a forecast. (FT Alphaville)

More low beta and low volatility ETFs coming to market via Russell. (IndexUniverse)

Taking the good with the bad when it comes to high frequency trading. (Data Diary)

The St. Joe Company (JOE) story just keeps on getting more interesting. (Dealbook, Kid Dynamite)

Strategy

Jessica Peletier, “Trading allows traders to design their lives.” (Rogue Traderette)

Why so few investors take advantage of the rebalancing bonus. (Capital Spectator)

Steven E. Landsburg, “Glassman has a substantial history of confusion about how financial markets work.” (The Big Questions)

Independent financial advisors are changing the investment landscape. (Bloomberg)

Technology

More color on the JP Morgan Chase (JPM)-Twitter investment talk. (Term Sheet)

Apple (AAPL) is going to push to make iPhones more affordable. (The Tech Trade)

Hewlett-Packard (HPQ) is cheap for a reason. (Crossing Wall Street)

Groupon invades China. (Crain’s Chicago)

The flaws in the smartphone index. (TrendRida)

A look at the Twitter user base. (Leigh Drogen)

General Motors

Is the new GM (GM) just like the old GM? (Mean Street)

Uh oh. Auto lending is back. (NYTimes)

A look at credit default swaps on the new GM. (WSJ, Felix Salmon)

Global

James Surowiecki, “What the region [Middle East] needs is less crony capitalism and more competition.” (New Yorker also beyondbrics)

The important role that currency appreciation plays in emerging markets investments. (beyondbrics)

The Egyptian stock market is set to re-open. (Dealbook)

Economy

The Chicago PMI continues to show economic vigor. (Calculated Risk, Bespoke)

Personal income surprises on the upside. (Credit Writedowns)

More on the effect higher oil prices may have on the global economy. (FT Alphaville)

Earlier on Abnormal Returns

Are falling stock correlations likely to lead to quality stock outperformance? (AR Screencast)

Our Monday morning live link look-in. (Abnormal Returns)

Errata

What the census tells about the changes underway in America. (Joel Kotkin)

George Will, “The national pastime is no longer baseball–it’s rent-seeking.” (EconTalk)

Rahm Emanuel takes over a Chicago that is “hip” (and broke). (Newsweek also Crain’s Chicago)

Who will be famous 10,000 years from now? (Marginal Revolution)

Thanks for checking in with Abnormal Returns. For all the latest you can follow us on StockTwits and Twitter.