Quote of the day

Jeff Davis, “Trading remotely is hard, lonely and liberating all at the same time.” (SMB Training)

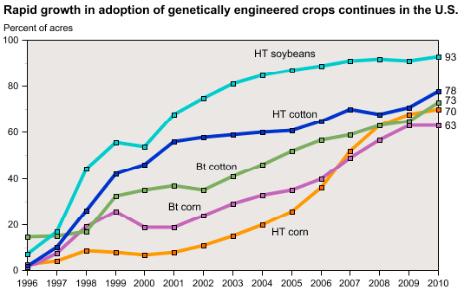

Chart of the day

On the rapid rise in the adoption of genetically modified crops in the US. (Atlantic Wire also Bloomberg)

Markets

Keep an eye on the high momentum names. (Kid Dynamite)

Volatility as an asset class would be great if it weren’t for that pesky contango in VIX futures. (FT Alphaville, ibid)

The Aussie dollar is poised for a pullback. (Data Diary)

Demand for grain storage, i.e. silos, is booming. (Climateer Investing)

Metals

Is silver in a bubble? (Pragmatic Capitalism also Globe and Mail)

A longer term look at the breakout in silver prices. (Afraid to Trade)

On the fungability of gold. (Kid Dynamite)

Gold stocks at a discount. (Focus on Funds)

A chart of real gold prices. (Carpe Diem)

Strategy

How to identify a ‘climax top.’ (Chris Perruna)

Preparing for the inevitable decoupling of commodities and equities. (the research puzzle)

Trading thinly traded names is a tricky business. (Dragonfly Capital)

Today we salute you, Mr. Complicated Technical Chart Guy. (I Heart Wall Street)

Hedge funds need to get above their high water marks, pronto. (Dealbook)

John Paulson is reportedly down for Q1. (Institutional Investor)

Hedge funds were pretty flat in March. (FINalternatives)

Companies

Check out the range of analyst estimates for iPhone sales. (Apple 2.0 also MarketBeat)

The case for Microsoft (MSFT) . (Kiplinger’s also StockCharts Blog)

Chipotle (CMG) and the search for “America’s Next Great Restaurant.” (footnoted)

Natural gas powered vehicles are a no-brainer. (The Reformed Broker)

Goldman Sachs (GS) doesn’t always win. The case of GSTrUE. (WSJ)

Is the online startup wave cresting? (Dealbook, ibid)

ETFs

Yet another firm jumps into the ETF fray. (IndexUniverse)

Fundamental indexing works its way into the corporate bond ETF space. (ETFdb)

“How many ETFs do we need to follow in order to track the world?” (ETFreplay)

There are much worse constructed indices than the Powershares QQQ (QQQ). (IndexUniverse)

Euroland

Post-Portugal all eyes turn to Spain. (Curious Capitalist, The Source)

The ECB hikes rates. (Real Time Economics, Free exchange)

The Euro shrugs off the latest news. (Street Sweep also Bruce Krasting)

Economy

The US is in danger of becoming [fill in the blank]. (Money Game)

Two indicators of a continued economic expansion. (ValuePlays)

Rising rents are a sign of hope for the housing market. (Calculated Risk, Modeled Behavior)

What measures of inflation expectations does the Fed watch? (FT Alphaville, Capital Spectator)

How would an end to QE2 affect the emerging markets? (beyondbrics also Fundmastery Blog)

Earlier on Abnormal Returns

Portugal caves and other morning links. (Abnormal Returns)

A list of our favorite ETF-focused sites. (Abnormal Returns)

Mixed media

A review of Bloomberg for the iPad. (VIX and More)

The case for having more kids. (Economix)

Abnormal Returns is a founding member of the StockTwits Blog Network.