Quote of the day

Edward Harrison, “(O)nce politicians set policy and commit to it by signing it into existence, they would rather risk losing office than change course.” (Credit Writedowns)

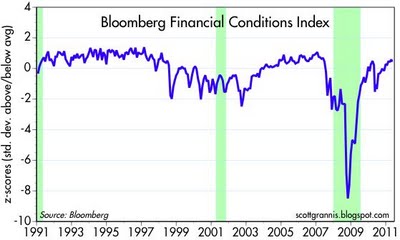

Chart of the day

Financial conditions look pretty healthy. (Calafia Beach Pundit)

Markets

Earnings momentum slows as margins come under pressure. (Pragmatic Capitalism)

Earnings growth has become more variable since the 1970s. (Money Game)

Global macro investors are having a tough time of things. (Institutional Investor)

What is a risk premium in a world of negative real interest rates? (Macroeconomic Resilience)

Keep an eye on the US dollar as a market tell. (Market Anthropology)

Commodities

Short term bearish, long term bullish on commodities seems to be a consensus position these days. (Insider Monkey)

The gold/silver ratio remains low by historical standards. (Bespoke)

The crack spread is “unstoppable.” (FT Alphaville)

Onion volatility is out of control. (FT Alphaville)

Strategy

Pattern recognition and how traders master the markets. (Investing With Options)

Short puts as limit orders. (Tyler’s Trading)

Advisors have gone from picking stocks to market timing ETFs. (Capital Spectator)

Start earning investment returns by focusing on not losing. (Bucks Blog)

Detailed notes from the West Coast Value Investing Congress. (The Inoculated Investor via Simoleon Sense)

Companies

The good, bad (and indifferent) opinions on the Microsoft (MSFT) deal for Skype. (TechCrunch, Herb Greenberg, Castellano)

Sotheby’s (BID) shows that margin pressure is happening among the hoi polloi. (Money Game)

What US companies are spending the most on capital spending. (Michael Mandel)

The US has a wireless spectrum deficit on its hands. (SAI)

Finance

Investment myopia is increasing. (FT Alphaville)

About that muni bond collapse. (Bonddad Blog, Kid Dynamite)

Currencies are not stocks. (Value Restoration Project)

Risk peaks three years after a firm’s IPO. (CFO Report)

Funds

Flatlining money market mutual funds. (FT Alphaville)

Who wouldn’t want an index named after them? (research puzzle pix)

A neat performance simulator comparing shorting bonds with leverage vs. a leveraged short bond ETF. (SymmetricInfo)

Just in case you didn’t know how to get auto exposure, the First Trust Nasdaq Global Auto Index Fund (CARZ). (IndexUniverse)

Global

Kicking the can down the road. A new Greek “rescue” is on tap. (WSJ, Macro Man)

Where to hide from the Euro. (The Source)

What if the BRICs become more self-sufficient in their food production? (Big Picture Agriculture via TRB)

Asia needs credit cards! (Money Game)

Economy

Don’t bet on a double-dip for the economy this year. (Marketwatch, Bloomberg)

Despite being highly uncertain econbloggers see better times ahead. (A Dash of Insight)

Small business optimism still in the tank. (Calculated Risk, MarketBeat, Money Game)

Why the inflation hawks have been wrong. (NetNet)

Can the US “muddle through” its financial problems or is a bold approach preferable? (Interfluidity)

Rail traffic was mixed in April. (Calculated Risk, Pragmatic Capitalism)

Earlier in Abnormal Returns

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

What does sentiment mean in a world of frictionless communication? (Dynamic Hedge)

The role of skill vs. luck in poker. In short, skill wins. (HuffingtonPost, Economix)

Does depression make us think better? (The Frontal Cortex)

Abnormal Returns is a founding member of the StockTwits Blog Network.