Quote of the day

Josh Brown, “We have a new type of hippie in 2011, only our modern hippies are much more lovable and productive for society at large than whatever was rolling around in its own filth 50 years ago.” (The Reformed Broker)

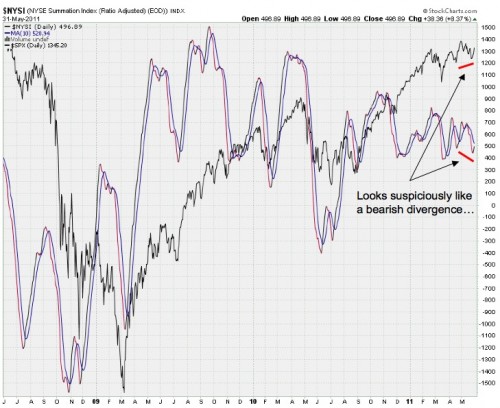

Chart of the day

Market breadth shows a narrowing rally. (Data Diary)

Markets

A nearly 7% spread in asset class performance in May. (Capital Spectator)

Cross-asset correlations are once again near peak levels. (FT Alphaville)

Stocks with the highest short interest ratios. (Bespoke)

What correlates with bond yields. (Pragmatic Capitalism)

Why the disconnect between stocks and house prices? (Felix Salmon)

Strategy

How rising stock prices can fool you. (Bucks Blog)

An interesting application of minimalist principles to options trading. (The Minimalist Trader)

A look at a tactical asset allocation model for June. (MarketSci Blog)

A slew of factor-focused, market neutral ETFs are set to launch. (IndexUniverse)

A spread trade sets up. (Dynamic Hedge)

The return on gems (please note the caveats). (CXO Advisory Group)

Technology

Speculation continues on what exactly will be included in next week’s iCloud unveiling. (TechCrunch, WSJ)

On the risks investors are taking to get foreign technology exposure. (Dealbook)

Twitter is taking back its future. (peHUB)

Is Nokia (NOK) worth less than Skype? (Asymco also 24/7 Wall St.)

Funds

David Einhorn is now investing in another hobby, poker. (market folly)

Hedge funds heart the white-label retail forex business. (WSJ, Insider Monkey)

Hedge funds are once again open to seeders. (Term Sheet)

Ten things learned from Steven Cohen’s SALT Conference interview. (Joe Fahmy)

An interview with Sunjay Gorawara the winner of the inaugural Ira Sohn contest winner. (Santangel’s Review)

Minneapolis is an up-and-coming hedge fund hub. (Dealbreaker)

Finance

A really strange story of Goldman Sachs (GS), Fabrice Tourre and read e-mails. (NYTimes, Felix Salmon, Litigation & Trial, Atlantic Business)

Muni bond issuance is running at 50% of 2010 levels. (Bond Buyer via @munilass)

The big bet Charles Schwab (SCHW) is making on the ETF business. (WSJ, NetNet)

On the challenges of turning around money manager Legg Mason (LM). (research puzzle pix)

Online investment advisory services are popping up to help even the smallest investors. (NYTimes)

Global

China’s financial restructuring begins. (Money Game, naked capitalism, Credit Writedowns)

A surprising list of top markets in 2011. (AllETF)

Economy

ADP private employment undershoots expectations. (Calculated Risk, MarketBeat, FT Alphaville also Money Game)

The ISM Manufacturing index slowed in May. (Fund My Mutual Fund, Calculated Risk, Pragmatic Capitalism)

Temp staffing is still holding up well. (ValuePlays)

Drags on the economy: housing never recovered and manufacturing is slowing. (WSJ, ibid)

The Taylor Rule is now point towards a 1% Fed funds rate. (Economics One via Zero Hedge)

A look at the relationship between expansionary policies and expectations for inflation and GDP growth. (Liberty Street)

A stunning change in family income expectations. (Economist’s View)

Housing

The housing market is bad, but not Great Depression bad. (Big Picture)

Home prices continue to plumb new price levels. (Calculated Risk)

The case against home ownership. (Slate)

Earlier on Abnormal Returns

Treasury yields continue to decline despite talk of financial repression and negative real yields. (AR Screencast)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Warren Buffett suffered from ‘motivated blindness.’ (HBR)

On the dangers of information overload. (GigaOM)

Tony Schwartz, “The struggle to feel valued is one of the most insidious and least acknowledged issues in organizations.” (HBR)

Abnormal Returns is a founding member of the StockTwits Blog Network.